IREIT Global.

annual report 2014

For the reporting period from 1 November 2013 (date of constitution) to 31 December 2014

Notes to the

Financial Statements

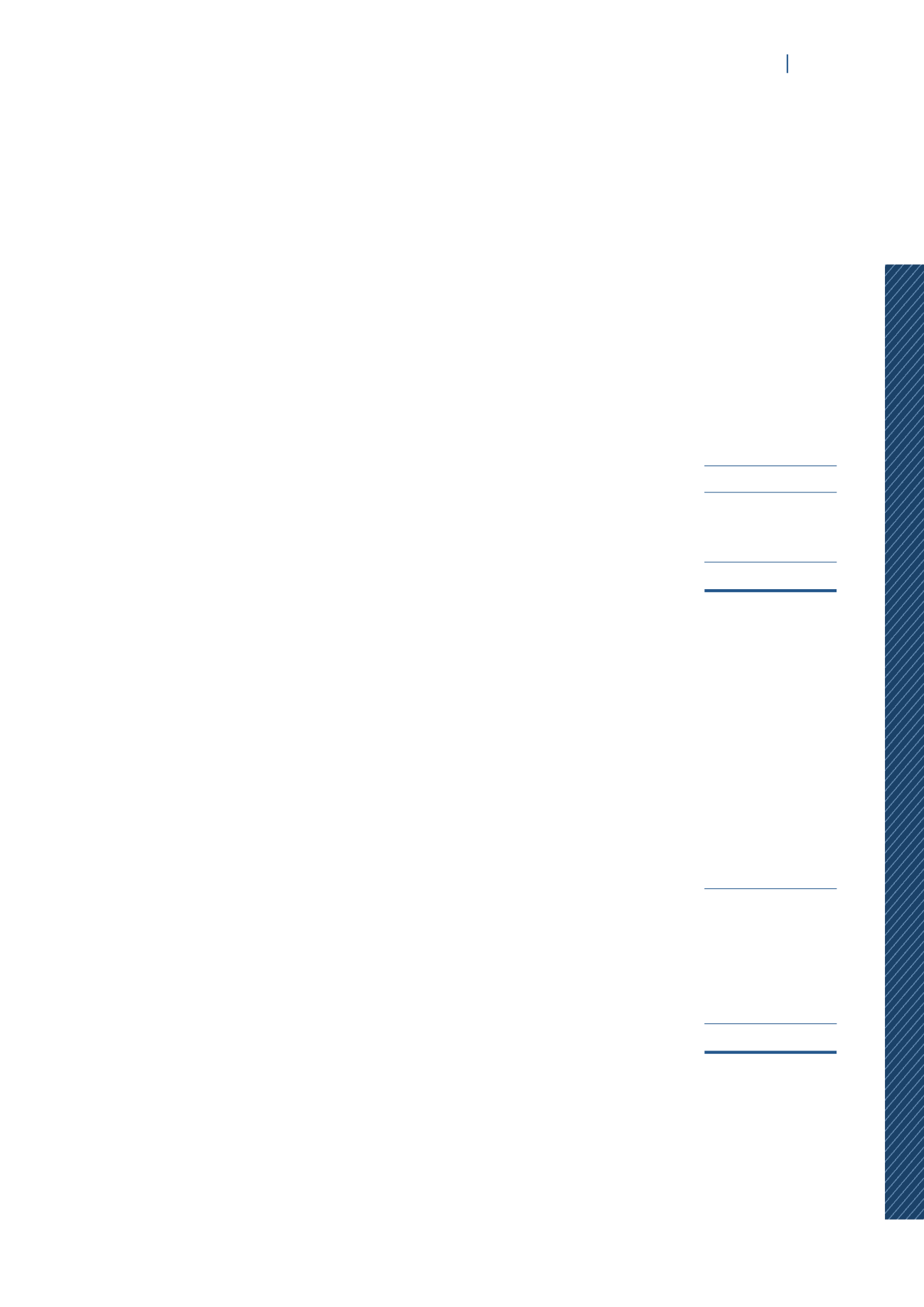

18.

INCOME TAX BENEFIT

Group

Period from

1 November

2013 (date of

constitution) to

31 December

2014

EUR’000

Current tax

–

Deferred taxation

– Current year

1,155

Total

1,155

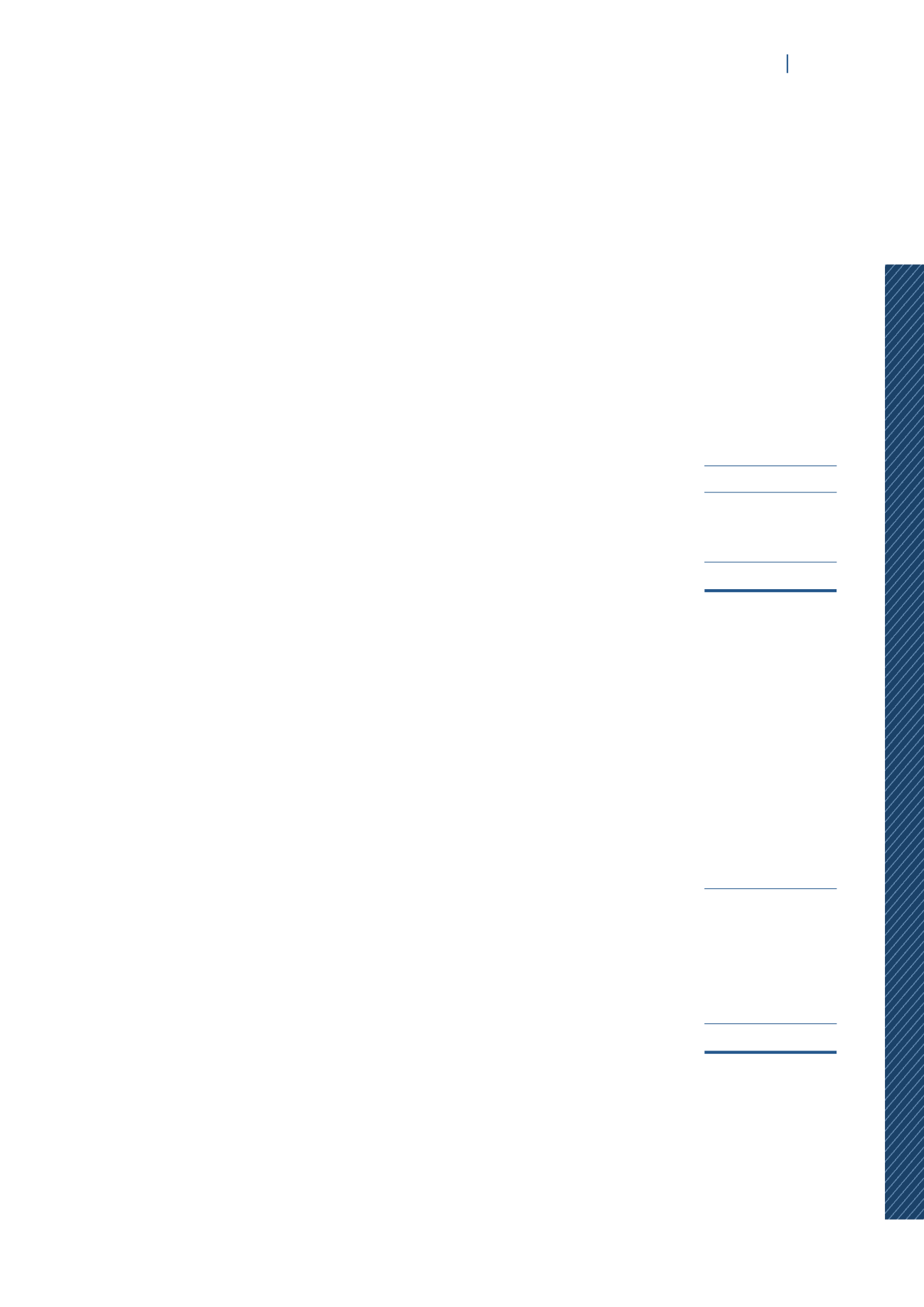

IREIT is subjected to Singapore income tax at 17% and the subsidiaries at approximately 15.85%

which is the tax rate prevailing in Germany where all the properties are located.

The income tax benefit for the period can be reconciled to the accounting loss as follows:

Group

Period from

1 November

2013 (date of

constitution) to

31 December

2014

EUR’000

Loss before taxation and transactions with unitholders

(7,335)

Tax at 17%

1,247

Tax effect of expenses not deductible for tax purposes

(257)

Tax effect of income not taxable for tax purposes

867

Effect of different tax rate of overseas operations

(702)

Tax benefit for the period

1,155