IREIT Global

annual report 2014

For the reporting period from 1 November 2013 (date of constitution) to 31 December 2014

Notes to the

Financial Statements

7.

INVESTMENT PROPERTIES

(Continued)

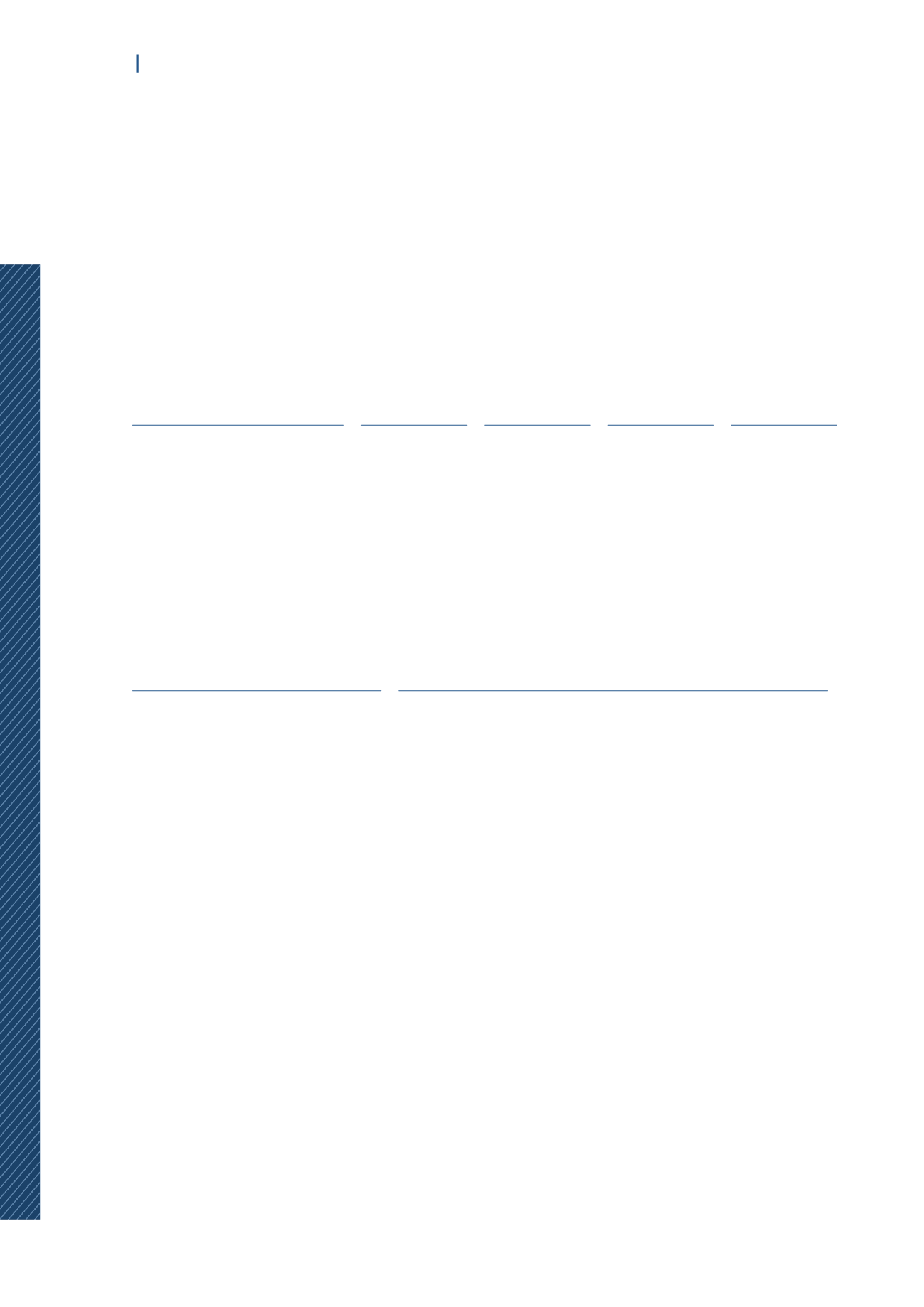

The following table presents the valuation techniques and key inputs that were used to determine

the fair value of investment properties categorised under Level 3 of the fair value hierarchy:

Valuation Techniques

Income

Capitalisation

Rate

Discount

Rate

Terminal

Capitalisation

Rate

Price per

square meter

Income capitalisation method 5.75% to 7.41%

–

–

–

Discounted cash flow

–

6.25% to 8.25% 5.5% to 7.5%

–

Depreciated replacement cost

method

–

–

–

Building: €1,250

Car park: €375

There are inter-relationships between the above significant unobservable inputs. An increase in

the income capitalisation rate, terminal capitalisation rate or discount rate will result in a decrease

to the fair value of investment properties. An increase in the estimated price per square meter

will result in an increase to fair value of the investment properties. An analysis of the sensitivity

of each of the significant unobservable inputs is as follows:

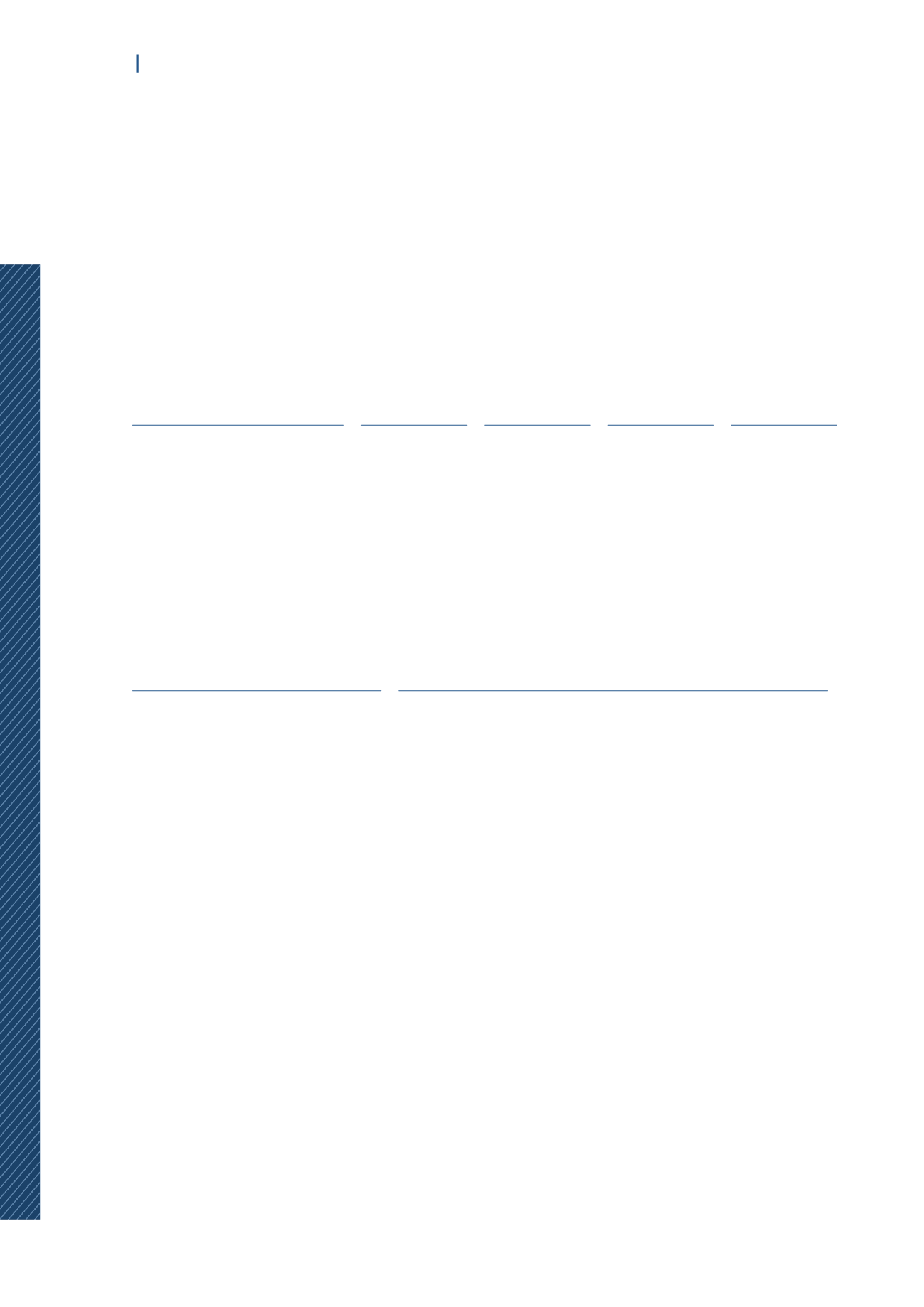

Method

Impact on carrying value of properties

Income capitalisation method

If income capitalisation rate were to increase by 0.5%, the

carrying value of investment properties would decrease by

approximately EUR 19.90 million.

Discounted cash flow method

If discount rate were to increase by 0.5%, the carrying

value of investment properties would decrease by

approximately EUR 11.40 million.

Depreciated replacement cost

method

If the price per square meter were to increase by 0.5%, the

carrying value of investment properties would increase by

approximately EUR 0.36 million.

Investment properties with a fair value of approximately EUR 290.6 million have been pledged

as security for bank loans. All the investment properties are located in Germany.