IREIT Global.

annual report 2014

For the reporting period from 1 November 2013 (date of constitution) to 31 December 2014

Notes to the

Financial Statements

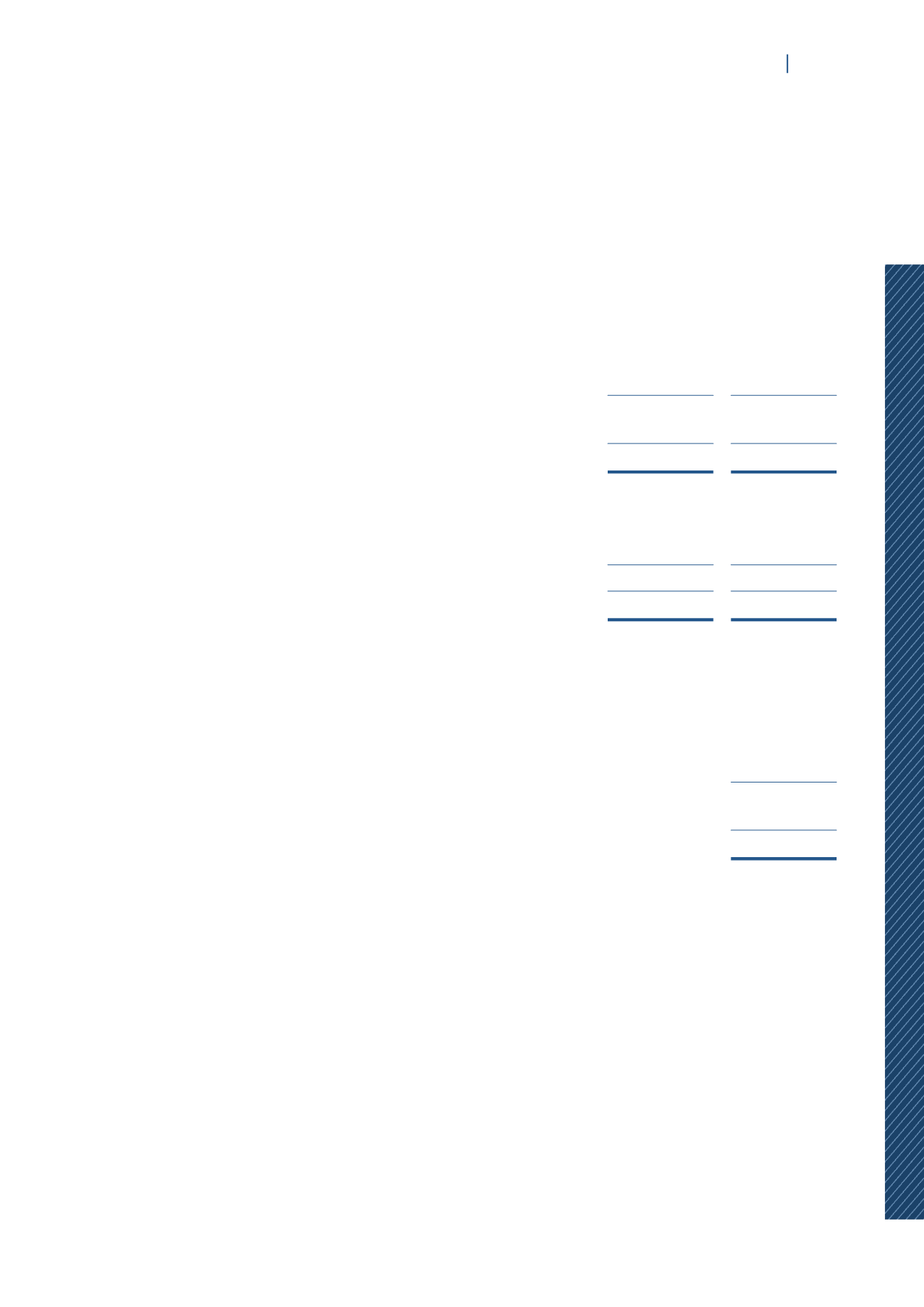

10.

TRADE AND OTHER PAYABLES

Group

IREIT

31 December

2014

31 December

2014

EUR’000

EUR’000

(a) Trade payables

Outside parties

115

–

115

–

(b) Other payables

Accrued expense and other payables

3,832

737

Interest payable

581

–

4,413

737

Total

4,528

737

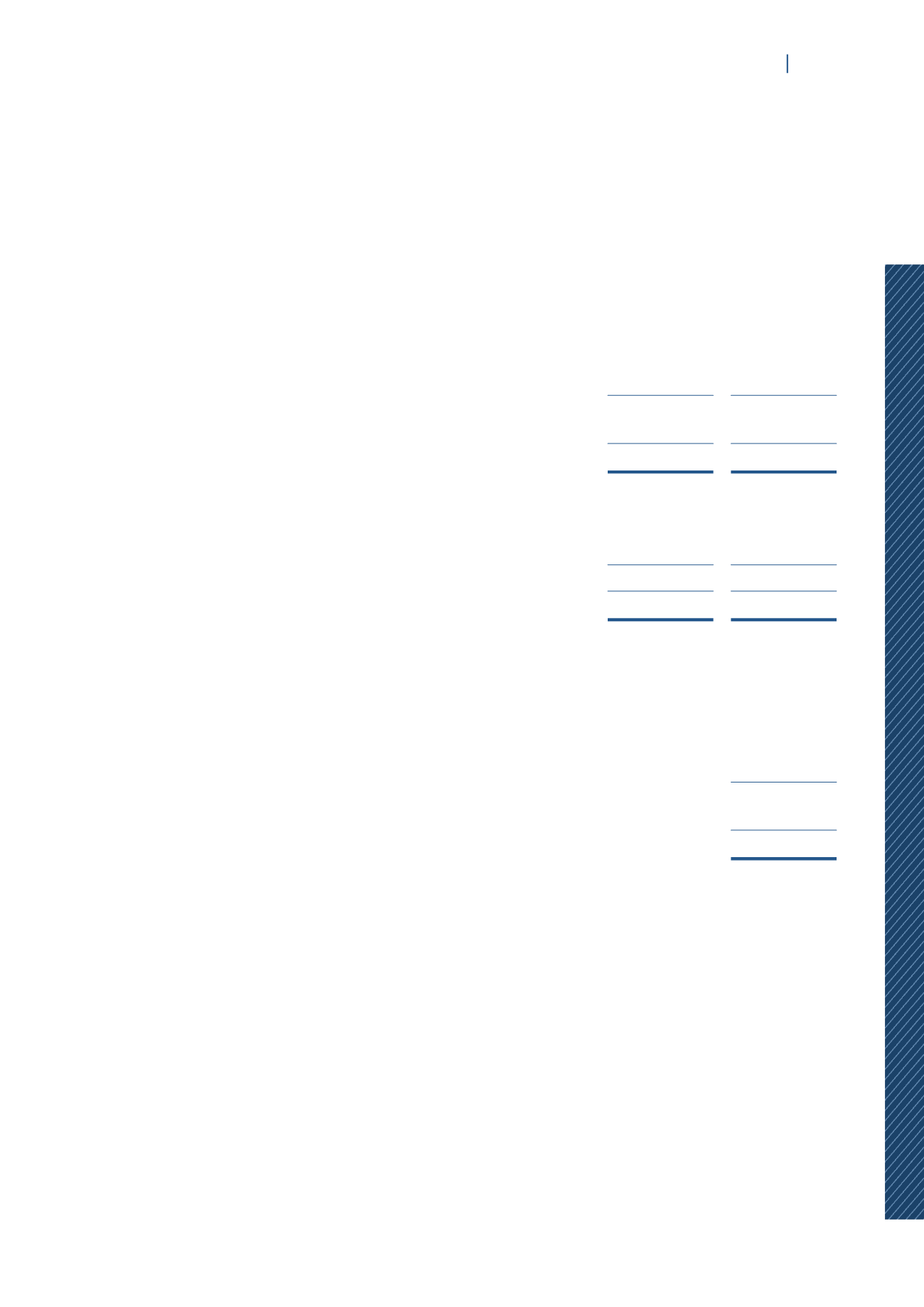

11.

BORROWINGS

Group

31 December

2014

EUR’000

Secured loans

96,594

Less: Unamortised transaction costs

(1,235)

Total

95,359

IREIT has in place a bank facility agreement with a bank in Germany for a 5-year term loan facility

(the “Facility”). The Facility has been fully drawn down as at 31 December 2014 as part payment

of the acquisition of the investment properties.

The Facility bears fixed interest rates throughout the tenure of the Facility with an average

effective interest rate of approximately 2.11% per annum including the amortisation of the debt

upfront transaction costs. The Facility is repayable on a bullet basis in 2019 and is secured on the

investment properties, the assignment of rental proceeds and a fixed charge over the rent and

deposit accounts of the investment properties.

The fair value of the bank borrowings as at 31 December 2014 is approximately EUR 98.40 million.