IREIT Global

annual report 2014

For the reporting period from 1 November 2013 (date of constitution) to 31 December 2014

Notes to the

Financial Statements

22.

FINANCIAL INSTRUMENTS

(Continued)

(b) Financial risk management objectives and policies

(Continued)

Liquidity risk

(Continued)

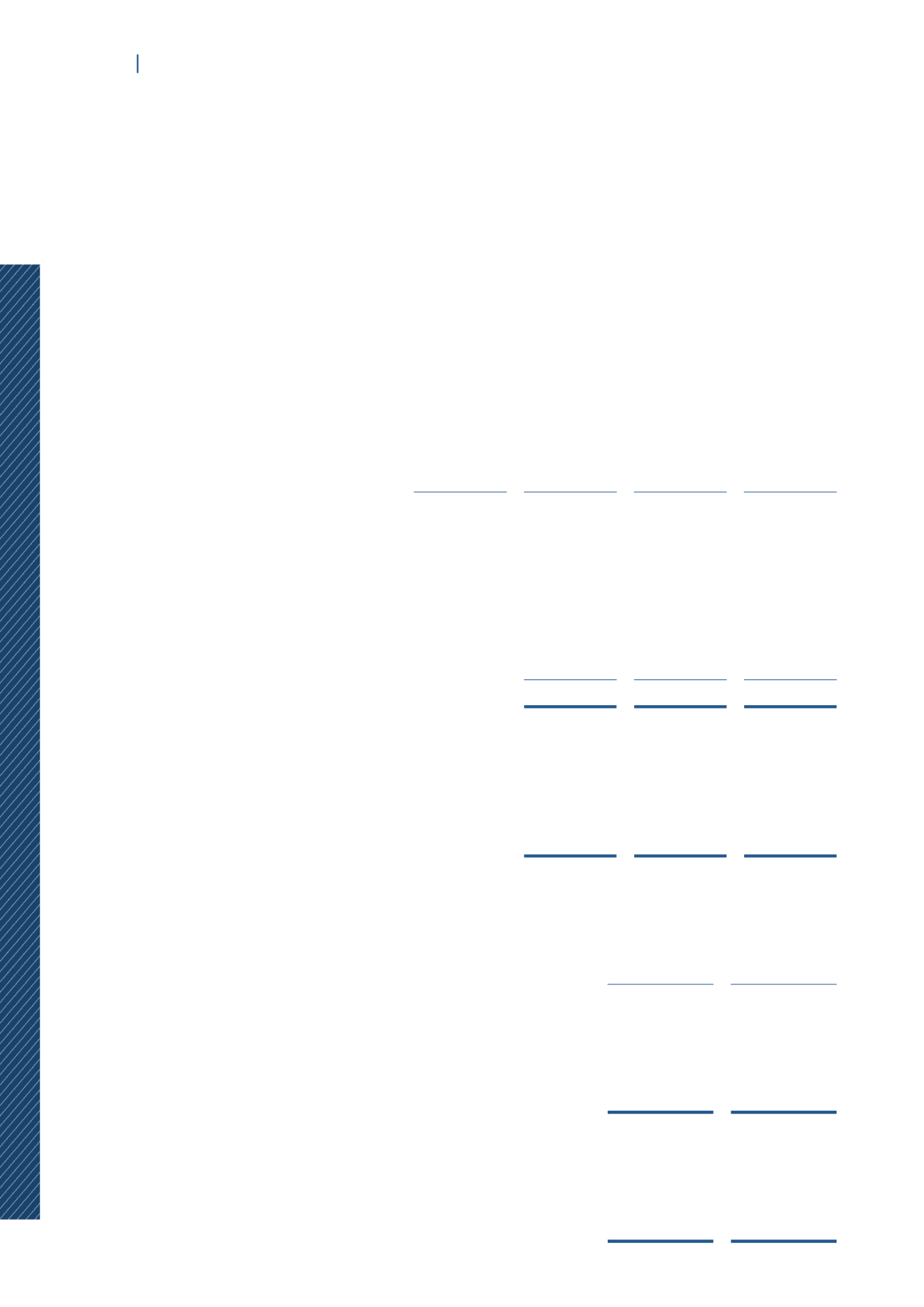

Group

Weighted

average

interest rate

On demand

or less than

12 months

Undiscounted

cash flows

2 years to

5 years

Carrying

amount as at

31 December

2014

% EUR’000 EUR’000 EUR’000

31 December 2014

(i) Non-derivative

financial instrument –

liabilities

Non-interest bearing

10,945

–

10,945

Fixed interest rate

instrument

2.11%

1,626

103,219

95,359

12,571

103,219

106,304

(ii) Derivative financial

instrument – gross

settled

Foreign exchange

forward contract

279

–

279

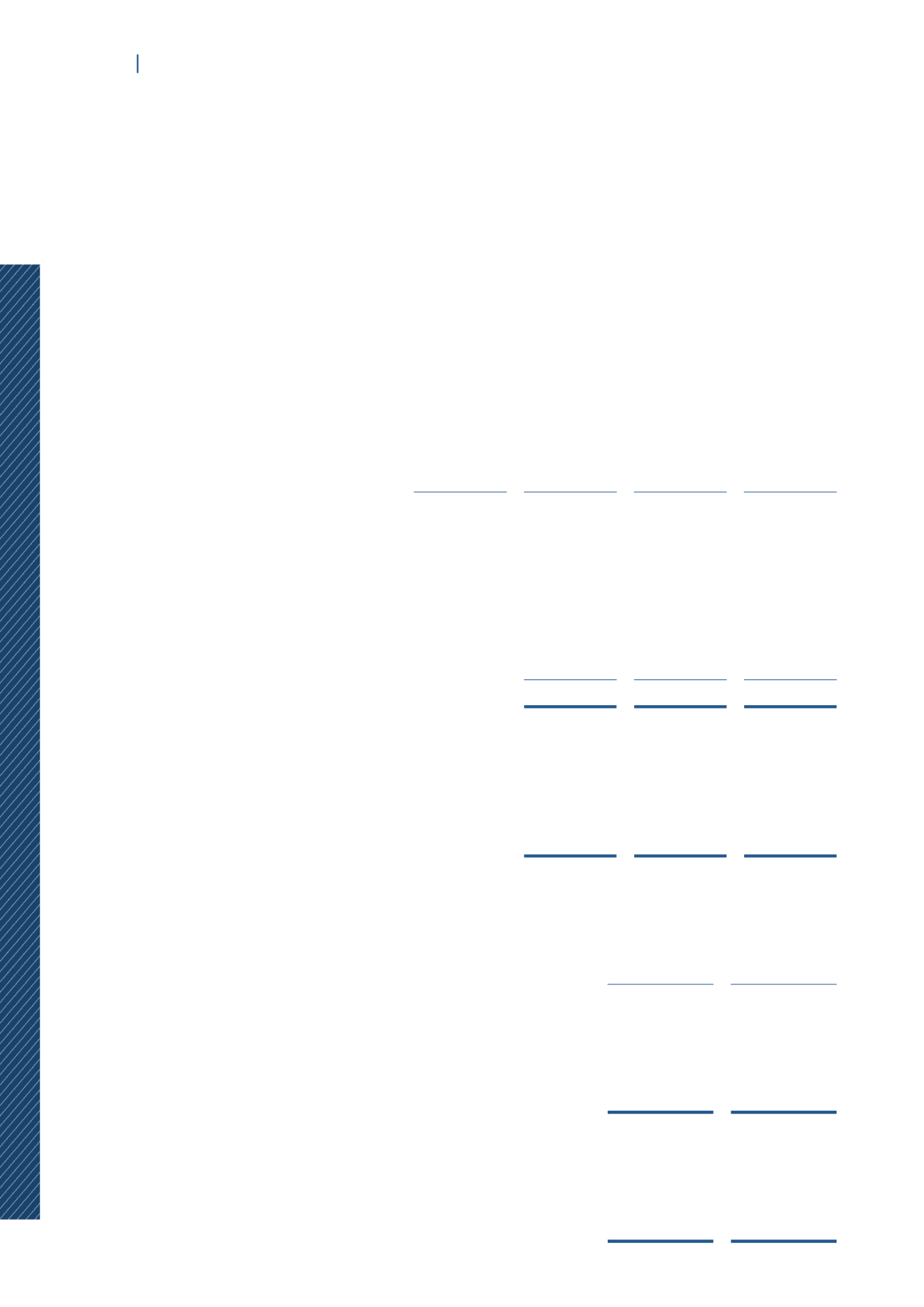

IREIT

On demand

or less than

12 months

Carrying

amount as at

31 December

2014

EUR’000

EUR’000

31 December 2014

(i) Non-derivative financial

instrument – liabilities

Non-interest bearing

7,154

7,154

(ii) Derivative financial instrument

– gross settled

Foreign exchange forward

contract

279

279