IREIT Global

annual report 2014

For the reporting period from 1 November 2013 (date of constitution) to 31 December 2014

Notes to the

Financial Statements

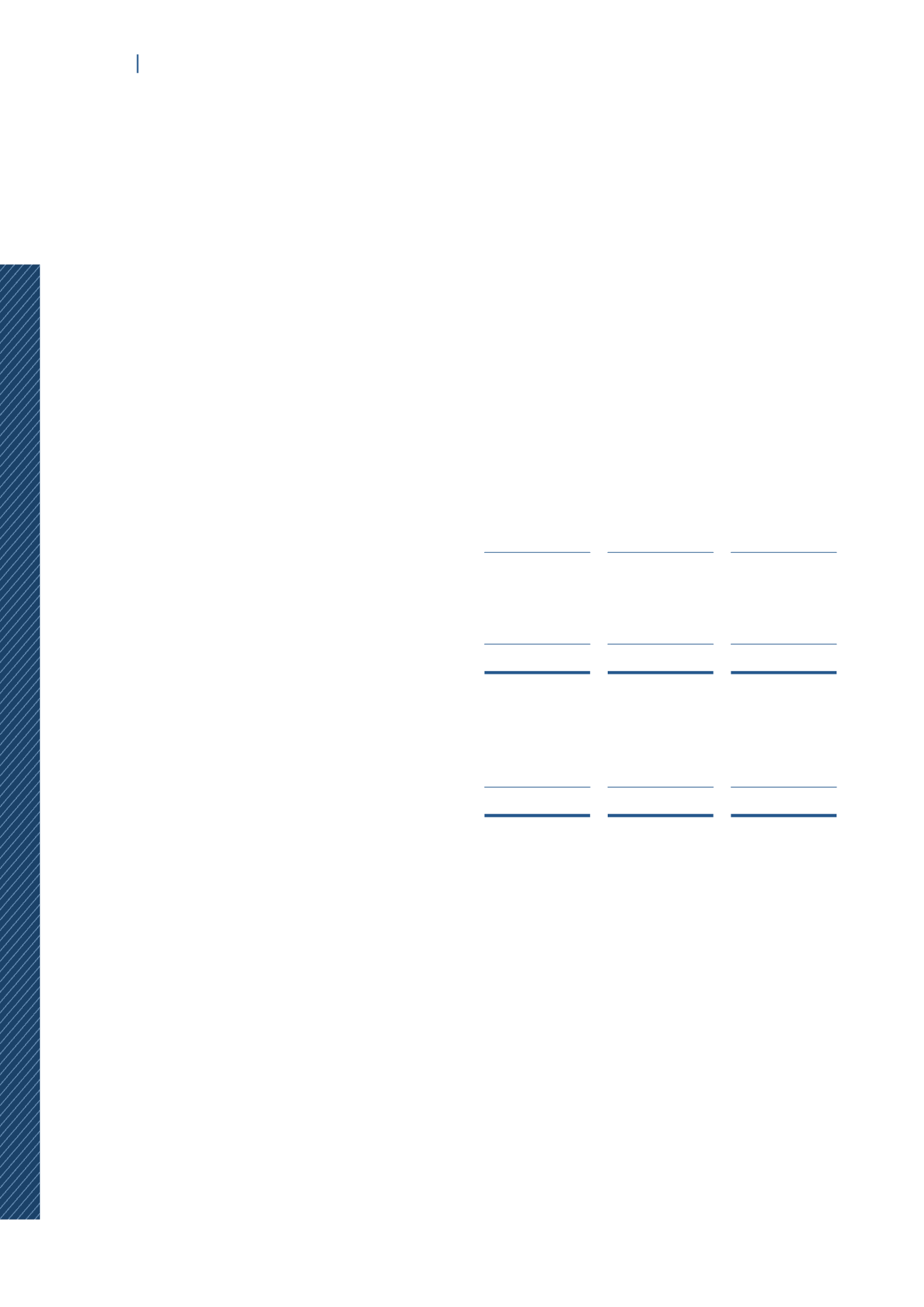

9.

DEFERRED TAX ASSETS/LIABILITIES

The measurement of deferred tax assets and liabilities reflects the tax consequences that would

follow from the manner in which the Group expects, at the end of the reporting period, to recover

or settle the carrying amount of its assets and liabilities.

The following are the major components of deferred tax (liabilities)/assets recognised and

movements therein during the period:

Group

Unutilised

tax losses

Revaluation

difference of

investment

properties

Total

EUR’000

EUR’000

EUR’000

Deferred tax assets

As at 1 November 2013

(date of constitution)

–

–

–

Recognised in profit or loss

116

1,275

1,391

Balance as at 31 December 2014

116

1,275

1,391

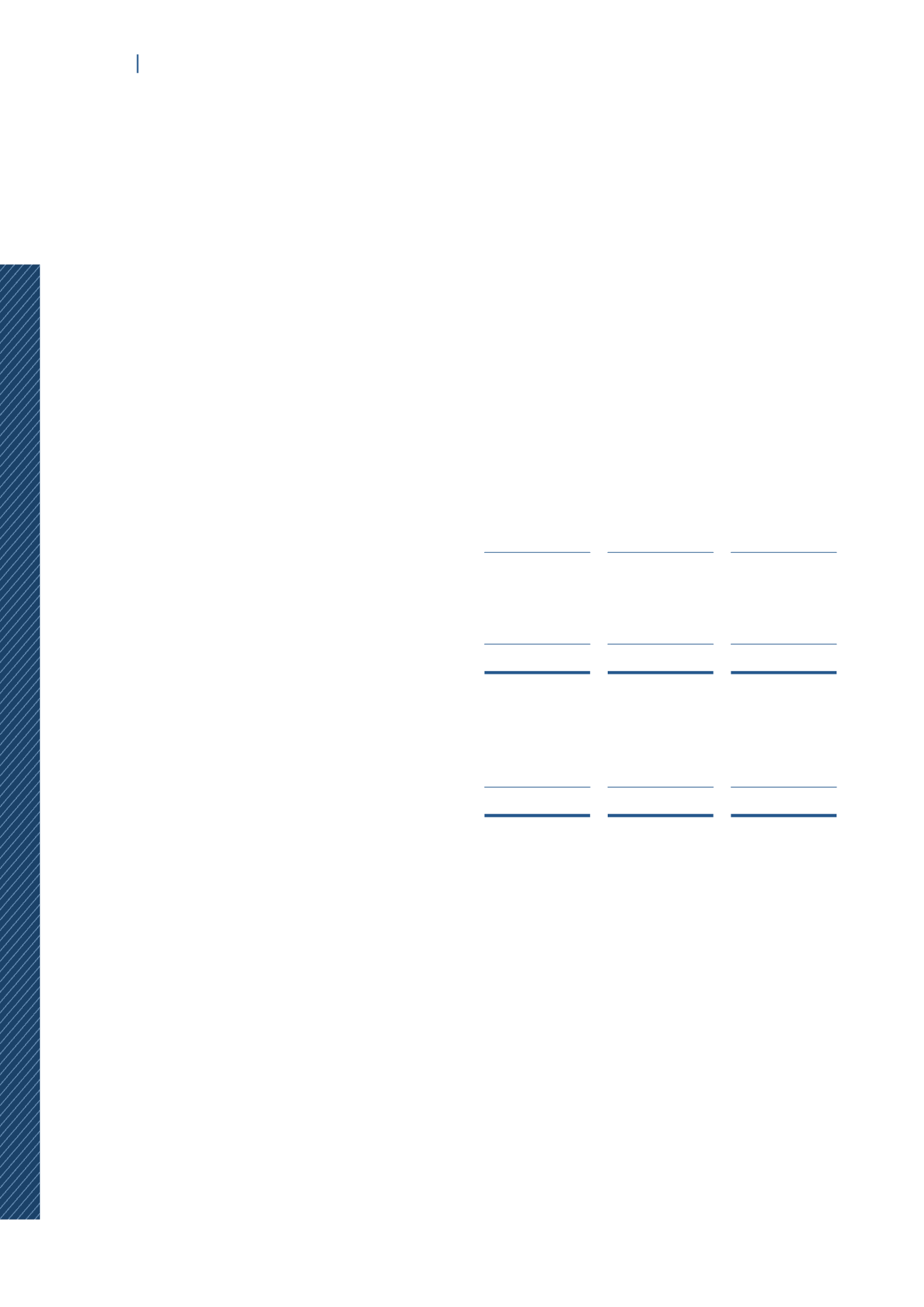

Deferred tax liabilities

As at 1 November 2013

(date of constitution)

–

–

–

Recognised in profit or loss

–

(236)

(236)

Balance as at 31 December 2014

–

(236)

(236)