IREIT Global.

annual report 2014

For the reporting period from 1 November 2013 (date of constitution) to 31 December 2014

Notes to the

Financial Statements

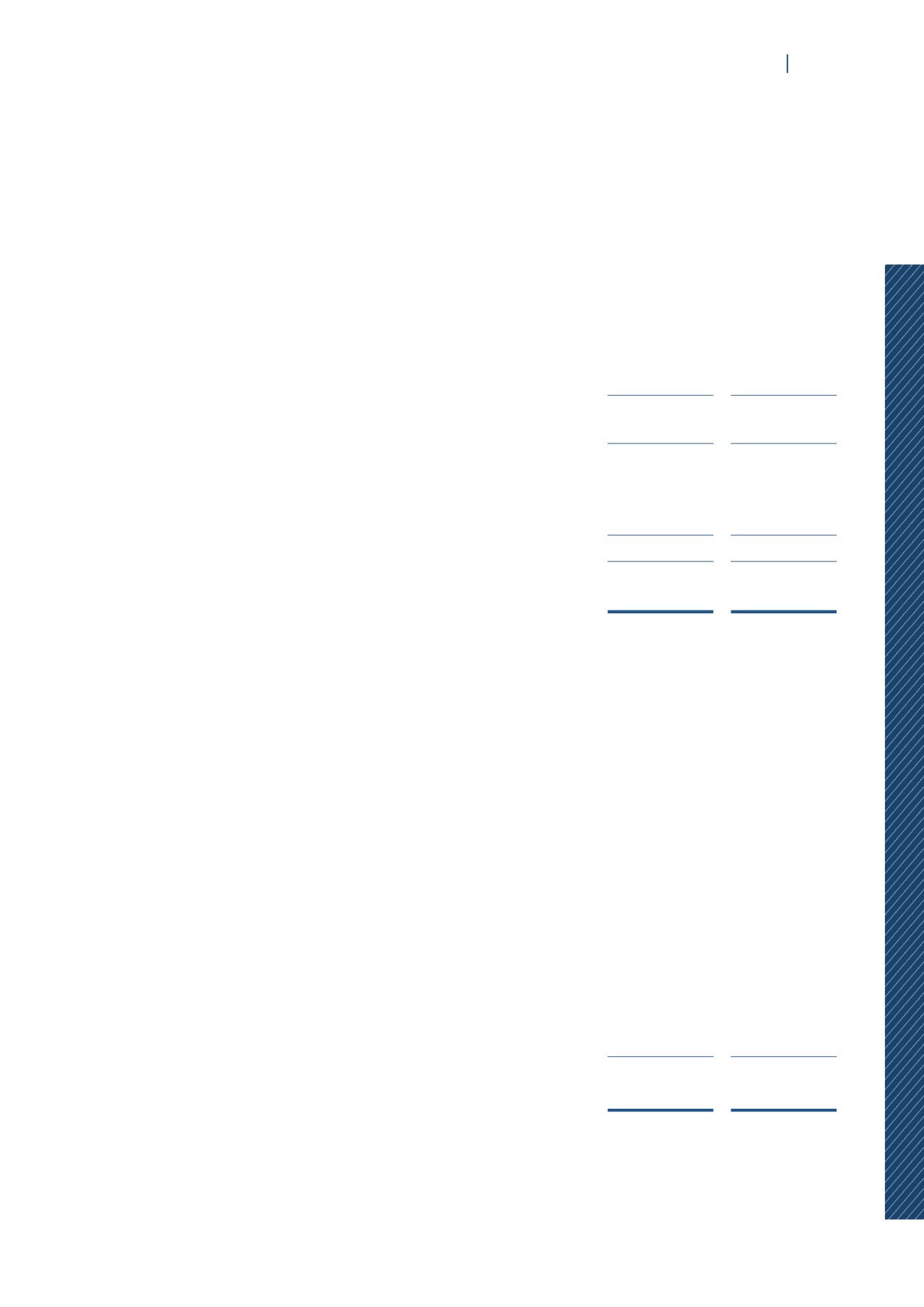

5.

TRADE AND OTHER RECEIVABLES

Group

IREIT

31 December

2014

31 December

2014

EUR’000

EUR’000

(a) Trade receivables

Outside parties

553

–

(b) Other receivables and prepayments

Other receivables

1,146

6,047

Prepayments

268

–

1,414

6,047

Total

1,967

6,047

The average aging of trade receivables is between 1 – 5 days, with no amounts past due or

impaired. The average credit period on billing for rental of properties is 2 days. No interest is

charged on the trade receivables.

In determining the recoverability of a trade receivable the Group considers any change in the

credit quality of the trade receivable from the date credit was initially granted up to the end of the

reporting period. The trade receivables as at the end of the reporting period include EUR 497,231

owing by a vendor of the investment properties in relation to the settlement of property operating

expenses.

Included in other receivables at IREIT level is an amount of approximately EUR 4.8 million of

dividend receivable from subsidiaries.

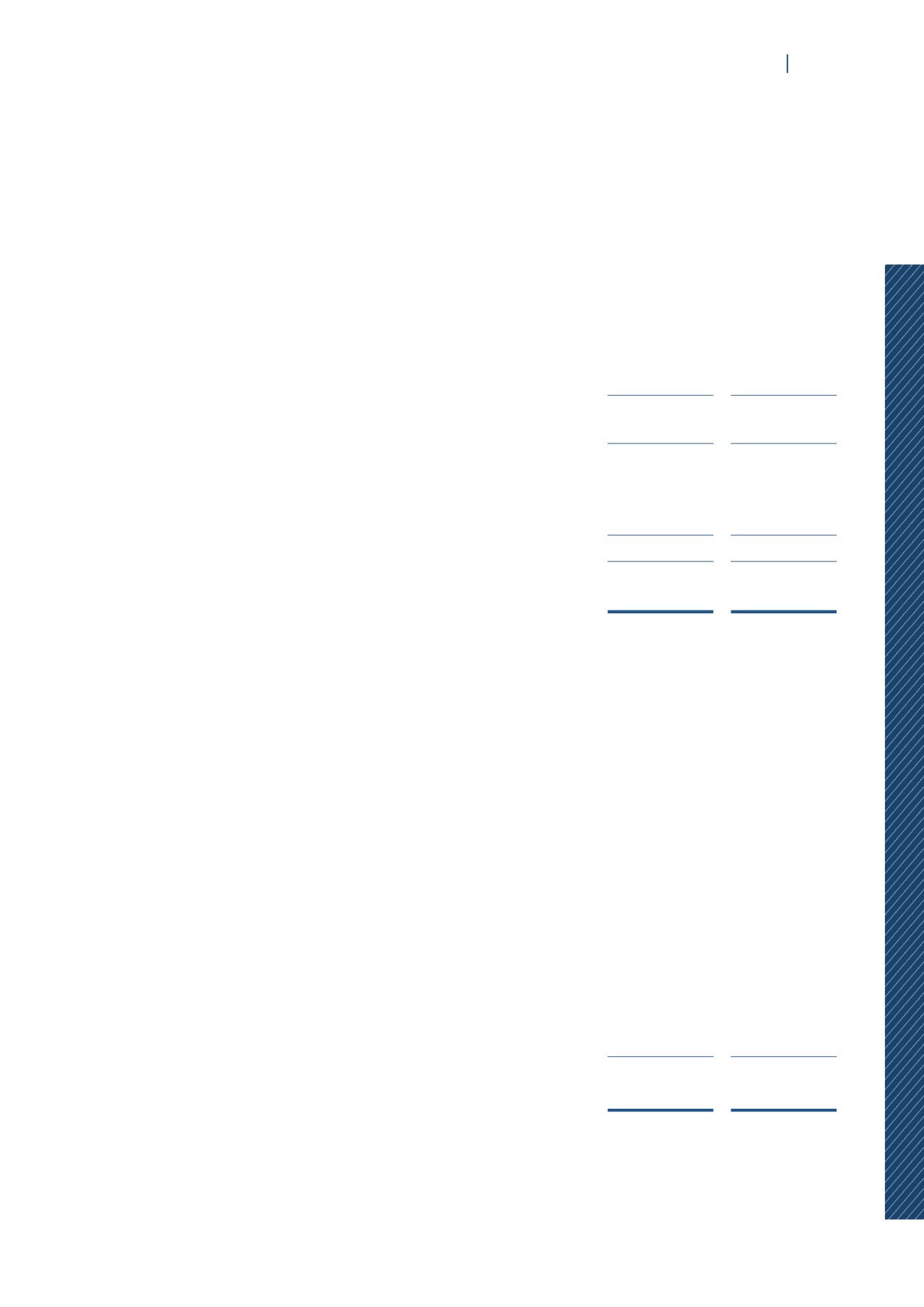

6.

FINANCIAL DERIVATIVES

Group

IREIT

31 December

2014

31 December

2014

EUR’000

EUR’000

Foreign currency forward contract

279

279

The functional and presentation currency of the IREIT is Euro, whereas the distributions to

unitholders will be denominated in Singapore Dollar. In order to economically hedge the potential

foreign currency fluctuation between Euro and Singapore Dollar, IREIT may enter into foreign

currency forward contract (the “contract”) to economically hedge the foreign currency exposure,

when appropriate.