While investor demand was focussed mainly on prime

VWRFN LQYHVWRUV DUH LQFUHDVLQJO\ RSHQ WR UHQWDO JURZWK

SURVSHFWV LQ QRQ FRUH ORFDWLRQV $V D UHVXOW LQYHVWRUV DUH

ZLOOLQJ WR FRQVLGHU VKRUWHU LQFRPH VWRFN $V GHPDQG LV VWLOO

well ahead of supply, prime yields are expected to remain

under downward pressure over the coming year.

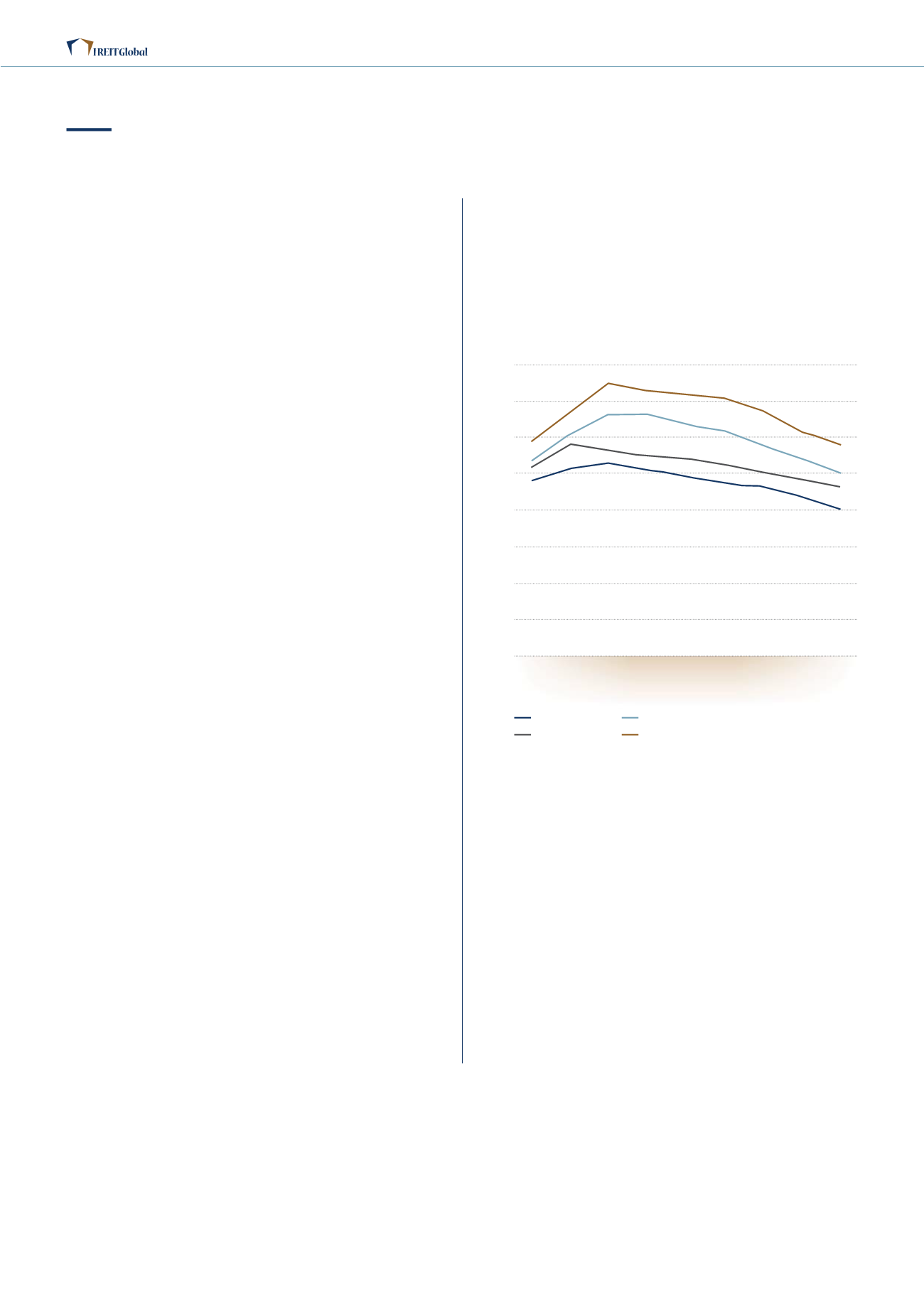

YIELDS OFFICE PROPERTY SECTOR BY LOCATION

German

Market Review

INVESTMENTS

7KH LQYHVWPHQW PDUNHW LQ *HUPDQ\ LQ ZDV H[WUHPHO\

buoyant with a 50.0% year on year increase in transaction

volume. Overall, yields have compressed in all top seven

locations. While all the top seven cities in Germany

experienced an increase in volume compared to the

previous year, the largest rise was recorded in Berlin.

&RPSDUHG WR

WKH FLW\ȇV WUDQVDFWLRQ YROXPH GRXEOHG

to more than €3.8 billion.

2ɝFH SURSHUW\ UHPDLQV WKH PRVW VRXJKW DIWHU VHFWRU LQ WKH

*HUPDQ UHDO HVWDWH PDUNHW 3URSHUWLHV FKDQJHG KDQGV IRU D

total of almost €22.9 billion last year, representing a 28.0%

increase from the previous year.

General economic indicators and the situation on the

ȴQDQFLQJ PDUNHW FRQWLQXH WR KDYH D SRVLWLYH HHFW RQ WKH

*HUPDQ FRPPHUFLDO UHDO HVWDWH PDUNHW ΖQYHVWRUV VKRZHG

D FOHDU IRFXV RQ WKH WRS VHYHQ FLWLHV $OPRVW

RI WKH

overall transaction volume in 2015, approximately €17.8

ELOOLRQ ZDV LQYHVWHG LQ WKHVH PDUNHWV 7KH KLJK PDUNHW

liquidity indicates the popularity of high-volume assets

DQG SDFNDJH GHDOV ZKLFK DUH VSXUULQJ PDUNHW DFWLYLW\

$SSUR[LPDWHO\ Ȝ ELOOLRQ ZDV LQYHVWHG LQ SDFNDJH GHDOV

LQ UHȵHFWLQJ D WRWDO WUDQVDFWLRQ YROXPH RI

2QH

of the highest-volume single deals in the year included

7LVKPDQ 6SH\HUȇV SXUFKDVH RI WKH 4 RIILFH UHWDLO PL[

building for around €330.0 million.

7KH LPSRUWDQFH RI WKH WRS PDUNHWV ZKLFK DFFRXQWHG

IRU DQ DOPRVW

VKDUH RI WKH WRWDO PDUNHW DV ZHOO DV

LQFUHDVLQJ WUDQVDFWLRQ DFWLYLW\ LQ Ȇ%ȇ DQG Ȇ&ȇ ORFDWLRQV DUH

good indications of Germany’s excellent standing with both

*HUPDQ DQG IRUHLJQ LQYHVWRUV -XVW RYHU KDOI RI LQYHVWPHQW

LQ WKH *HUPDQ UHDO HVWDWH PDUNHW FDPH IURP LQWHUQDWLRQDO

LQYHVWRUV LQ

ZLWK WKRVH IURP WKH 86$ )UDQFH DQG

WKH 8. IDYRXULQJ KLJK YROXPH GHDOV 0HDQZKLOH $VLDQ

investors contributed around €1.4 billion. While foreign

investment accounted for around 51.0% of the total in most

RI WKH WRS VHYHQ FLWLHV 0XQLFK DQG 6WXWWJDUW JDUQHUHG OHVV

foreign interest with foreign investment recorded at 43.0%

and 33.0% respectively.

2ɝFH EXLOGLQJV DQG KRWHO DVVHWV JDLQHG WKH PRVW LQYHVWRU

interest on the whole, especially as the structure of the

hotel business in Germany continues to expand in all

FODVVHV +LJK YROXPH VLQJOH DVVHW GHDOV LQFOXGHG WKH QLQH

ILJXUH 6RILWHO 0XQLFK %D\HUSRVW +RWHO %RWK RIILFH DQG

hotel asset classes well exceeded €2 billion in investment

turnover.

OUTLOOK 2016

Occupational and investment demand are forecast to

strengthen further in 2016 with increased demand for

space in second-tier locations. Demand will continue to

H[FHHG VXSSO\ DFURVV PRVW SULPH PDUNHWV ZLWK YDFDQF\

rates expected to see further moderate declines. Older

RɝFH EXLOGLQJV ZLOO FRQWLQXH WR EH XVHG DV UHIXJHH KRXVLQJ

which would lead to vacant space absorption.

Given the current stability of the German economy,

EXVLQHVVHV DUH RSWLPLVWLF DERXW WKH IXWXUH DQG DUH ORRNLQJ

forward to leasing new office space. Tenant demand is

expected to remain strong over the coming year, which

VKRXOG OHDG WR D VFDUFLW\ RI KLJK HQG RɝFH VSDFH LQ PDQ\

locations.

6RXUFH 6DYLOOV

8%

7%

6%

5%

4%

3%

2%

1%

0%

2007 2008 2009 2010 2011

2012 2013 2014 2015

6HFRQGDU\ QRQ &%'

3ULPH QRQ &%'

6HFRQGDU\ &%'

3ULPH &%'

Qualifying Note

7KLV *HUPDQ 0DUNHW 5HYLHZ LQFOXGHV PDUNHW LQIRUPDWLRQ DQG VWDWLVWLFDO GDWD REWDLQHG IURP LQGHSHQGHQW LQGXVWU\

SXEOLFDWLRQV DQG UHSRUWV LQFOXGLQJ WKRVH IURP WKH )HGHUDO 6WDWLVWLFDO 2ɝFH RI *HUPDQ\ 'HVWDWLV &ROOLHUV ΖQWHUQDWLRQDO

&XVKPDQ :DNHȴHOG DQG 6DYLOOV :RUOG 5HVHDUFK ZKLFK ZH EHOLHYH DUH UHOLDEOH VRXUFHV :H KDYH QRW LQGHSHQGHQWO\

YHULȴHG WKH GDWD QRU VRXJKW WKH FRQVHQW RI DQ\ RI WKHVH RUJDQLVDWLRQV WR UHIHU WR WKHLU UHSRUWV IRU WKLV *HUPDQ 0DUNHW

5HYLHZ :KLOH HYHU\ HRUW KDV EHHQ PDGH WR HQVXUH WKH LQIRUPDWLRQ VRXUFHG LV DFFXUDWHO\ UHSUHVHQWHG LQ WKH *HUPDQ

0DUNHW 5HYLHZ ZH FDQQRW DFFHSW DQ\ UHVSRQVLELOLW\ IRU DQ\ HUURUV RU RPLVVLRQV

34