German

Market Review

&DSLWDOLVLQJ RQ VHFRQGDU\ FLWLHV

ΖQ WKH OLJKW RI Ζ5(Ζ7ȇV Ȇ$%%$ȇ LQYHVWPHQW VWUDWHJ\ Ȃ SXUVXLQJ

Ȇ%ȇ SURSHUWLHV LQ Ȇ$ȇ FLWLHV Ȃ DQG RXU GLYHUVH SRUWIROLR LQ

*HUPDQ\ȇV NH\ FLWLHV RI %RQQ 'DUPVWDGW 0¾QVWHU 0XQLFK

DQG PRVW UHFHQWO\ %HUOLQ ZH FRQWLQXH WR WDNH D NHHQ

interest in secondary cities which are attractive real estate

locations.

Darmstadt

$ QRWHZRUWK\ PHQWLRQ LV 'DUPVWDGW ZKLFK H[SHULHQFHG VRPH

activity that was dominated by development transactions in

the last year.

7KH 7HFKQRORJ\ 3DUN LQ 'DUPVWDGW KDV EHHQ K\SHG XS E\

GHYHORSPHQW VFKHPHV OHG E\ .ROE 3DUWQHUV 7KH QHZ

UHGHYHORSPHQW RQ :HVW 6LWH DW

0LQD 5HHV 6WUDſH LV

14,000 sqm, of which about 50.0% is already leased out to

'HXWVFKH 7HOHNRP

&ROOLHUV ΖQWHUQDWLRQDO UHSRUWHG WKDW SULPH UHQWV LQ 'DUPVWDGW

have remained unchanged at around €13.00 per sqm while

B-class refurbishments are letting at about €8.00 per sqm.

Bonn

7KH FLW\ȇV RɝFH PDUNHW KDV UHPDLQHG IDLUO\ VWDEOH RYHU WKH

\HDU $ WDNH XS UDWH RI

VTP ZDV UHFRUGHG LQ WKH

FLW\ GXULQJ WKH ȴUVW KDOI RI

FRPSDUHG WR

VTP

for the whole of 2014. Only a small number of larger

investment transactions were made in Bonn, including the

'Ζ& $VVHW $* DFTXLVLWLRQ RI &LUFOH &HQWHU RQ 3RWVGDPHU

3ODW] LQ %RQQ IRU Ȝ PLOOLRQ IURP 'HXWVFKH 2ɝFH DW D \LHOG

of approximately 6.0%.

Münster

$FFRUGLQJ WR &ROOLHUV ΖQWHUQDWLRQDO 0¾QVWHUȇV RɝFH PDUNHW

KDV

PLOOLRQ VTP RI RɝFH VSDFH ZKLFK LV D QHW LQFUHDVH

RI

VTP WKLV \HDU 0¾QVWHU KDV H[SHULHQFHG D UHFRUG

WDNH XS RI

VTP PRVWO\ IRFXVHG LQ WKH FHQWUDO

EXVLQHVV GLVWULFW &%' 1HZ EXLOGLQJV LQ WKH &%' KDYH

an average headline rent of €13.50 per sqm while new

buildings outside the city centre are letting at an average of

€11.50 sqm per month. Older properties and those located

RXWVLGH WKH &%' LQ WKH 0¾QVWHU 1RUG DUHD DUH OHWWLQJ DW DQ

average of €9.00 per sqm.

9$&$1&Ζ(6

With demand currently ahead of supply, vacancy rates

dropped in all top cities in the year with 2015 third quarter’s

ȴJXUHV DJDLQVW WKH VDPH SHULRG LQ WKH SUHYLRXV \HDU GRZQ

0.7%. Steep falls were recorded in some cities. Stuttgart

continued to have the lowest vacancy rate at 3.6%, just

VOLJKWO\ EHWWHU WKDQ 0XQLFK DW

$W

%HUOLQ ZDV QRW

IDU EHKLQG +DPEXUJ DQG &RORJQH UHFRUGHG YDFDQF\ UDWHV

of 5.6% and 6.2% respectively while the rate for Düsseldorf

ZDV

)UDQNIXUW LV WKH RQO\ PDMRU FLW\ ZLWK D GRXEOH

digit vacancy rate of 11.6%.

$URXQG PLOOLRQ VTP RI RIILFH VSDFH ZDV DYDLODEOH IRU

immediate occupancy in these cities in 2015 and occupancy

rates stabilised at around 80.0%. With comparatively little

new build space scheduled to be added to supply in the

FRPLQJ \HDUV DQG VRPH PLOOLRQ VTP RI RɝFH VSDFH

under construction as at September 2015 (a decrease of

0.7% year on year), vacancy rates are forecast to continue

to drop.

1

0HDQZKLOH LQ WKH Ȇ%ȇ FLWLHV WKH YDFDQF\ UDWH LQ %RQQ QRZ

VWDQGV DW

$W RQO\

LQ 0¾QVWHU KDV WKH ORZHVW

YDFDQF\ UDWH LQ DOO Ȇ%ȇ ORFDWLRQV LQ *HUPDQ\ ΖWV YDFDQF\ UDWH

has been in continuous decline since 2010.

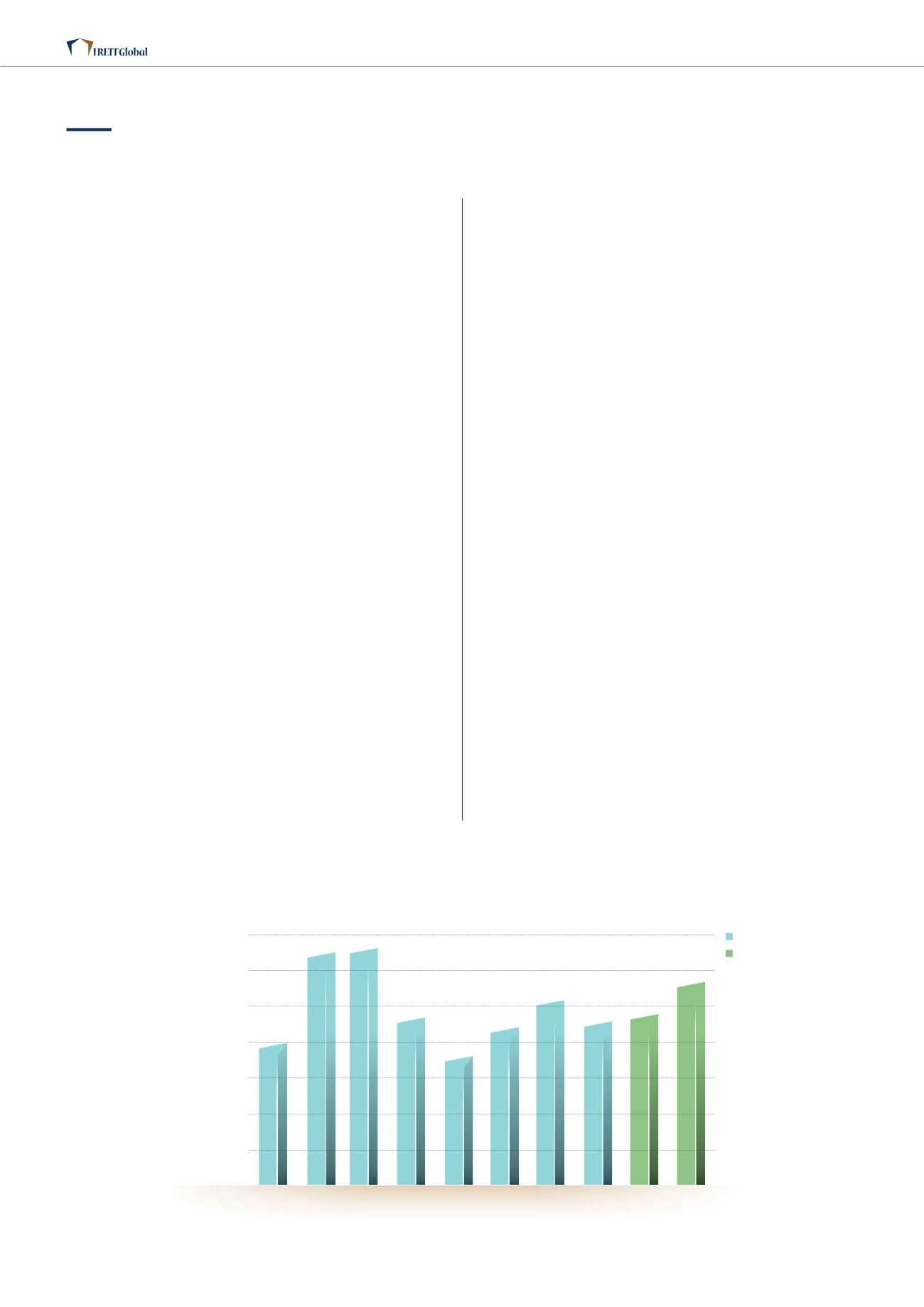

DEVELOPMENT PIPELINE

2ɝFH FRPSOHWLRQV

2ɝFH VSDFH XQGHU

construction / Pipeline

2008

200,000

0

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

2009 2010 2011

2012 2013 2014 2015 2016 2017

sq m

769,000

1,273,600

1,295,300

914,100

689,600

858,700

1,003,600

886,800

931,200

1,101,800

6RXUFH 6DYLOOV

32