Corporate

Governance Report

Accountability and Audit Accountability

Principle 10: Presentation of a balanced and understandable

assessment of performance, position and prospects

The Board is responsible to give a balanced and

comprehensive report on the performance, position,

SURVSHFWV VWUDWHJ\ DQG PDUNHW RXWORRN LQFOXGLQJ RWKHU

price sensitive reports to the regulators (if required). To

ensure this is accomplished efficiently, management

provides timely, accurate and adequate information to

the Board.

The Board is required to release quarterly results

and full year results of IREIT as well as price sensitive

announcements and all other regulatory announcements,

DV UHTXLUHG E\ UHJXODWRUV 4XDUWHUO\ ILQDQFLDO UHVXOWV

and price sensitive information and regulatory required

announcements are disseminated to Unitholders via

6*;1(7 SUHVV UHOHDVHV Ζ5(Ζ7ȇV ZHEVLWH PHGLD DQG DQDO\VW

EULHȴQJV

Risk Management and Internal Controls

Principle 11: The Board is responsible for the governance of

risk. The Board should ensure that the Manager maintains

a sound system of risk management and internal controls

to safeguard IREIT’s assets and Unitholders’ interests and

VKRXOG GHWHUPLQH WKH QDWXUH DQG H[WHQW RI WKH VLJQLȴFDQW

risks which the Board is willing to take in achieving its

strategic objectives

7KH 0DQDJHU KDV SXW LQ SODFH VXIILFLHQW DQG HIIHFWLYH

ULVN FRQWURO PHDVXUHV WR DGGUHVV ILQDQFLDO RSHUDWLRQDO

compliance, information technology security, and other

SRWHQWLDO ULVNV 7KLV LV WR VDIHJXDUG 8QLWKROGHUVȇ LQWHUHVWV

DQG PDQDJH ULVN 7KH %RDUG LV UHVSRQVLEOH IRU WKH

JRYHUQDQFH RI ULVNV DQG IRU RYHUVHHLQJ WKH HQIRUFHPHQW RI

ULVN PDQDJHPHQW VWUDWHJ\ DQG IUDPHZRUN RI WKH 0DQDJHU

7KH %RDUG PHHWV HYHU\ TXDUWHU WR UHYLHZ DQG WUDFN WKH

ILQDQFLDO SHUIRUPDQFH RI WKH 0DQDJHU DQG Ζ5(Ζ7 DJDLQVW

DSSURYHG EXGJHWV DQG WDNLQJ QRWH RI DQ\ VLJQLILFDQW

changes on quarter-on-quarter and year-to-date results.

'XULQJ WKH UHYLHZ DQG DQDO\VLQJ EXVLQHVV ULVN WKH %RDUG

WDNHV LQWR FRQVLGHUDWLRQ WKH SURSHUW\ PDUNHW DQG HFRQRPLF

conditions where IREIT’s properties are located and other

UHODWHG ULVNV

$SDUW IURP WKLV WKH %RDUG DOVR UHYLHZV WKH ULVNV WR WKH

assets of IREIT, examines the management of liabilities,

and will act upon any comments from internal and external

auditors of IREIT.

ΖQ YLHZ RI WKH LPSRUWDQFH RI FRPSOLDQFH DQG ULVN

PDQDJHPHQW WKH $5& LV DVVLJQHG WKH GXW\ WR RYHUVHH WKLV

DVSHFW RI WKH 0DQDJHUȇV DQG Ζ5(Ζ7ȇV RSHUDWLRQV

7KH $5& UHYLHZV DQG DVVHVVHV WKH DGHTXDF\ RI WKH

0DQDJHUȇV ULVN PDQDJHPHQW FRQWURO PHDVXUHV WKDW

DUH HVWDEOLVKHG E\ PDQDJHPHQW $GGLWLRQDOO\ WKH $5&

supervises the implementation and operation of the

ULVN PDQDJHPHQW V\VWHP LQFOXGLQJ JRLQJ WKURXJK WKH

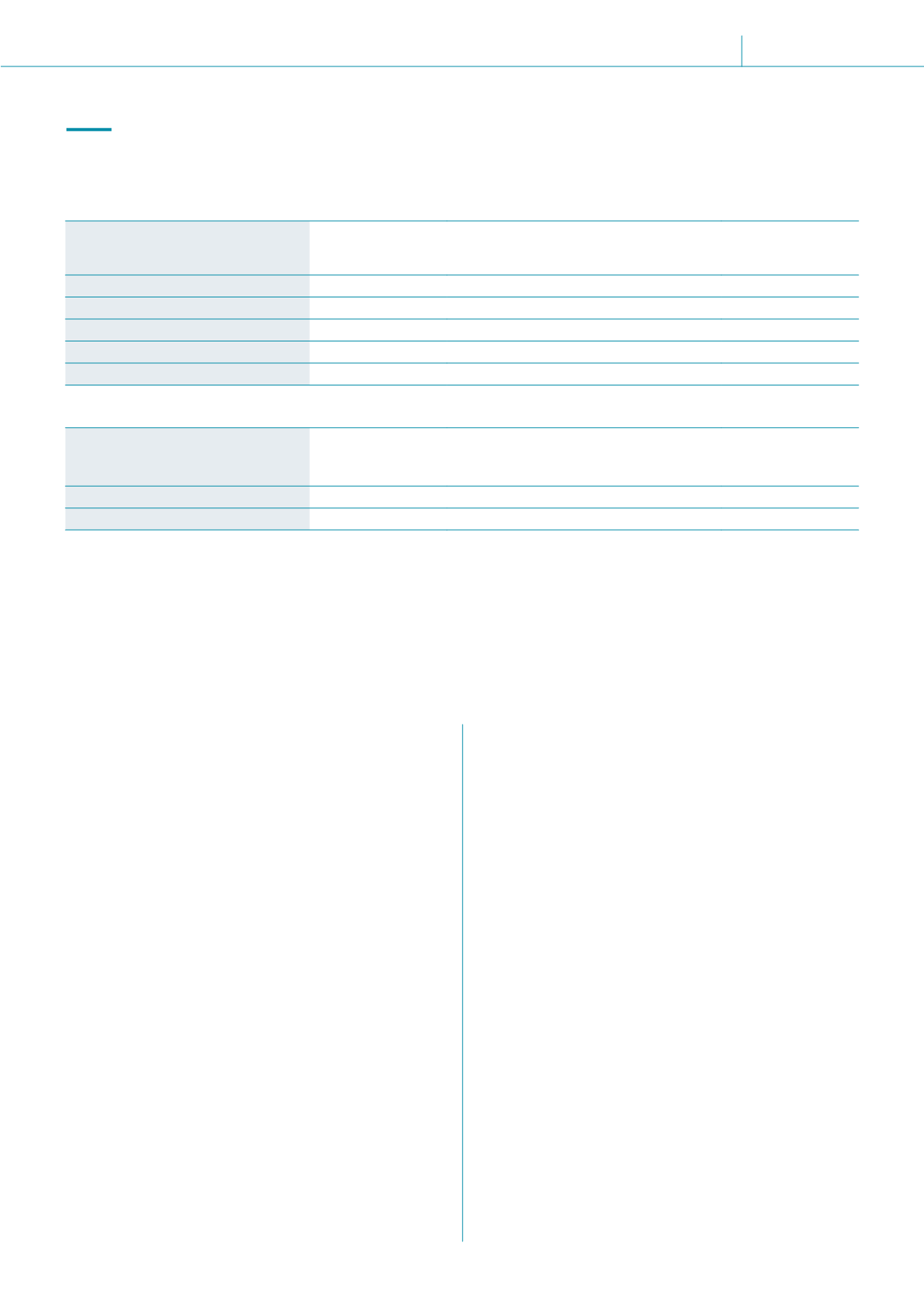

7KH OHYHO DQG PL[ RI WKH UHPXQHUDWLRQ RI HDFK RI WKH 'LUHFWRUV RWKHU WKDQ WKH &(2 IRU )< DUH DV IROORZV

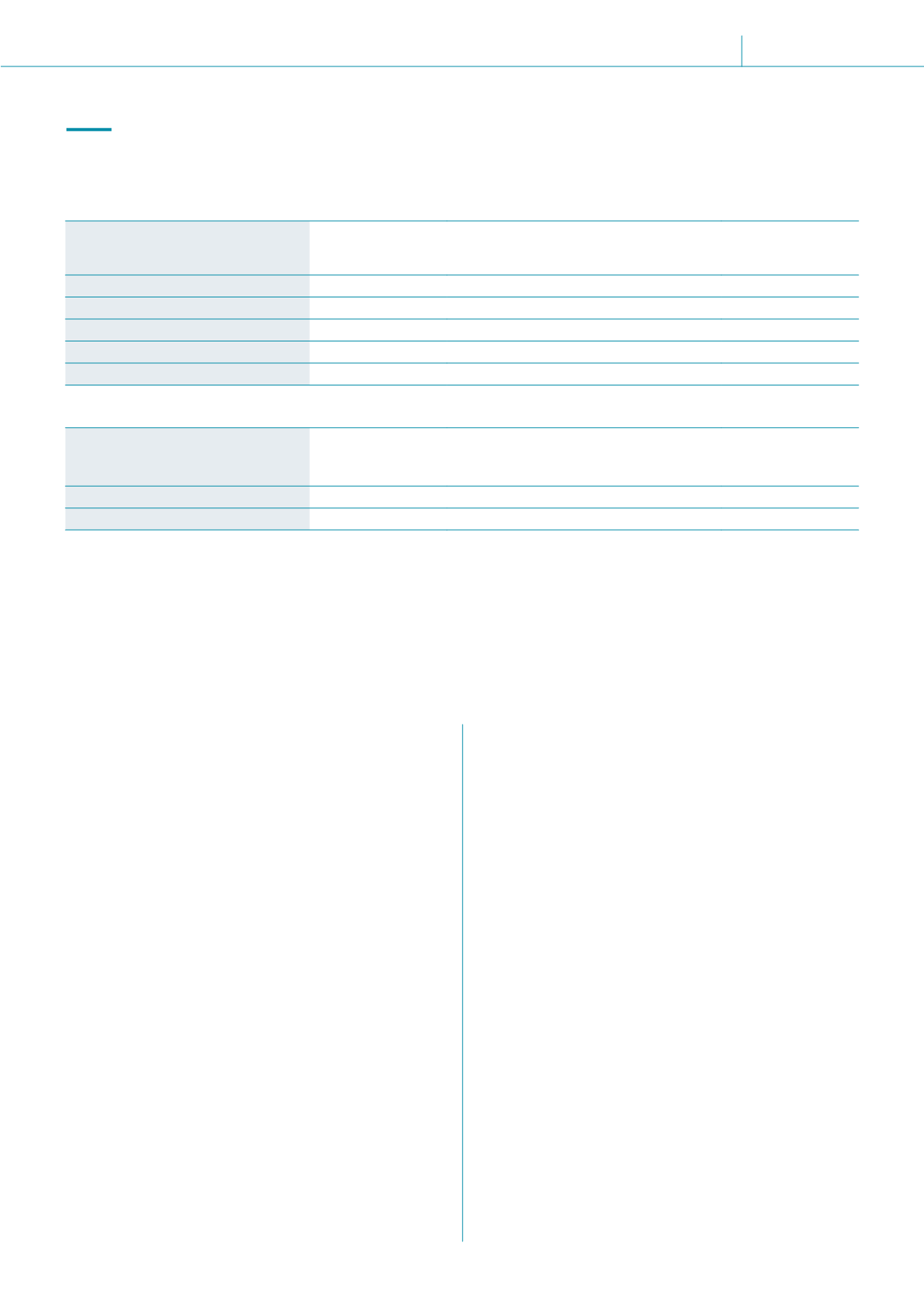

7KH OHYHO DQG PL[ RI WKH UHPXQHUDWLRQ RI WKH &(2 IRU )< LV DV IROORZV

(1) Paid in cash.

7KH %RDUG KDG DVVHVVHG DQG GHFLGHG WR SURYLGH GLVFORVXUH RI WKH UHPXQHUDWLRQ RI WKH 'LUHFWRUV RWKHU WKDQ WKH &(2

DQG WKH &(2 RQ D QDPHG EDVLV LQ H[DFW TXDQWXP DQG LQ EDQGV RI 6

UHVSHFWLYHO\ 7KH %RDUG FRQVLGHUV WKDW LW LV

LPSRUWDQW WR PDLQWDLQ VWDELOLW\ DQG FRQWLQXLW\ LQ WKH NH\ PDQDJHPHQW WHDP RI Ζ5(Ζ7 'XH WR FRQȴGHQWLDOLW\ FRQFHUQV DQG

JLYHQ WKH FRPSHWLWLYH SUHVVXUHV LQ WKH WDOHQW PDUNHW WKH %RDUG LV RI WKH YLHZ WKDW GLVFORVLQJ WKH UHPXQHUDWLRQ RI WKH &(2

LQ H[DFW TXDQWXP DQG WKH UHPXQHUDWLRQ RI WKH WRS ȴYH H[HFXWLYHV RQ D QDPHG EDVLV ZKHWKHU LQ H[DFW TXDQWXP RU LQ EDQGV

RI 6

PD\ VXEMHFW WKH 0DQDJHU WR WKH ULVN RI XQQHFHVVDU\ NH\ PDQDJHPHQW WXUQRYHU ZKLFK LQ WXUQ ZLOO QRW EH LQ

the best interests of IREIT and its Unitholders.

Name of Director

Fees

1

Base/Fixed Salary

Bonus

%HQHȴWV LQ NLQG

(S$’000)

(S$’000)

(S$’000)

(S$’000)

0U /LP .RN 0LQ -RKQ

95

-

-

-

0U 7DQ :HH 3HQJ .HOYLQ

80

-

-

-

0U 1LU (OOHQERJHQ

65

-

-

-

0U +R 7RRQ %DK

50

-

-

-

0U 7RQJ -LQTXDQ

50

-

-

-

Remuneration Band and Name

Fees

Base/Fixed Salary

1

Bonus

1

%HQHȴWV LQ NLQG

(%)

(%)

(%)

(%)

Above S$500,000 to $750,000

0U ΖW]KDN 6HOOD

-

62

28

10

IREIT Global

ANNUAL REPORT 2015

45