German

Market Review

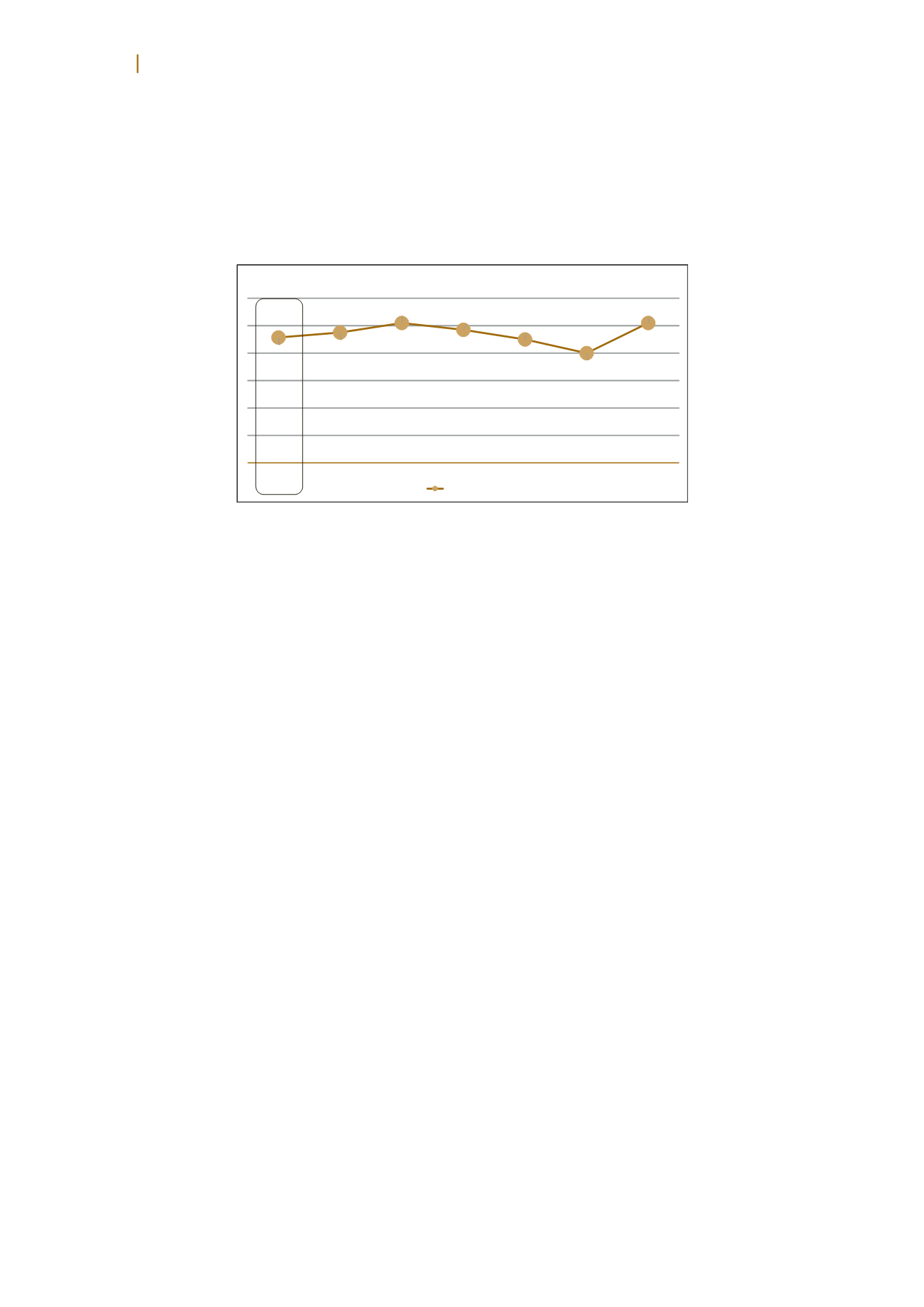

4.57% 4.75%

5.10%

4.85%

4.50%

4.00%

5.10%

GERMANY

BERLIN DÜSSELDORF FRANKFURT HAMBURG MUNICH STUTTGART

Prime Yields-Ofice

Prime yields

Source: Colliers International

Secondary Cities and IREIT’s Portfolio

According to a Deka Bank report fromDecember 2014 and

cited by Colliers International, many of the leading locations

for real estate in Germany are held by the secondary cities.

The survey included cities with populations of more than

200,000. Among the cities surveyed, which included the

big A cities such as Munich, Bonn was ranked seventh and

Munster eleventh as the most attractive places for real

estate. Munich retained the number one spot. Darmstadt’s

population fell below the 200,000 mark and was therefore

not included in the survey, however market indicators

showed that Darmstadt is also a leading and vibrant real

estate market in Germany.

Colliers International reported that Darmstadt has had

strong leasing and investment activity during 2014, with

an increase in take-up of 40% year on year. It was also

reported that most of the take-up was due to leasing as

opposed to purchasers. It is important to note that 80% of

the letting is attributed to second-hand rather than newly

built properties. The vacancy rate inDarmstadt remains low

at 3.6%. Most of the newly built offices have been pre-let

including the Deutsche Telekom Building in the TZ Rhein

Main business park. In general Colliers reports that office

rents are stable, with a slightly downward trend in the

average rental price due to the extensive number of second

hand lettings of varying quality.

Bonn and its Federal Quarter have shown a very strong

market performance for 2014. Colliers International

reported that therewere seven significant lease transactions

of between 2,000 and 4,100 sqm during 2014 in a current

market where most lettings are to smaller tenants less

than 500 sqm. The most popular location was the Federal

District, which absorbed 45%of the 37,500 sqm let during

2014. Colliers International reports that office rents in Bonn

are stable and vacancy remains low at 3.9%.

According to Colliers International the Munster office

market has remained stable. The letting market remains

the bastion of local and regional companies. The data on

exact vacancy levels has not been reported, however IREIT

estimates that the overall vacancy remains low at circa 5%.

Significant building starts and developments have not been

reported in the area except for the Induna property which

was built in the 1960’s and is slated for redevelopment

during the coming years.

Market Outlook for 2015

According to Colliers International, 2014 ended with a

transaction volume just above the ten year average. As

uncertainty continues to loom in Europe and the slowing

down in the German economy, analysts are expecting a

stable performance of the office occupational market in

2015. The market is anticipating that occupiers may delay

relocations or large scale lettings. However, as construction

activity in the sector remains at a very low level, vacant

office stock will likely continue to decrease.

Cushman & Wakefield LLP’s Marketbeat Office Snapshot

Report for Q4 2014 has forecast that the office take-up

levels in 2015 will probably match, if not exceed, those

of 2014. The demand is backed by positive growth in the

employment market and a high number of office leases

expiring in 2015. The same report also mentioned that

falling vacancy rates should boost higher investment

volumes in 2015 as investors compete for the best assets,

while the same occupiers may opt for more cost-effective

opportunities in secondary markets due to the expected

increase in prime rents.

IREIT Global

annual report 2014