German

Market Review

Investments in 2014

The favourable financing environment, low interest rates, massive liquidity, and Germany’s overall stable economic

status, were the main reasons for the increase in real estate investment.

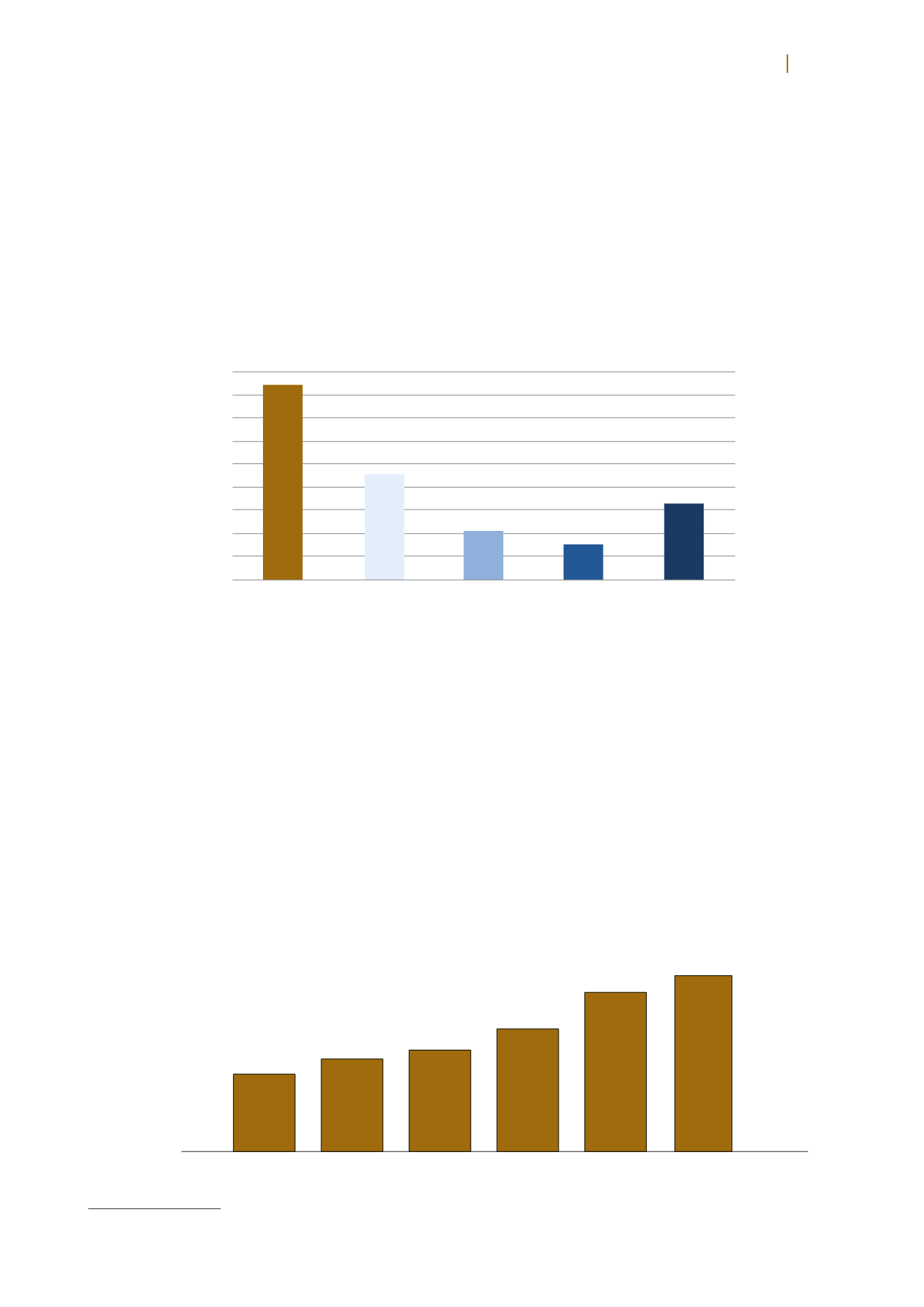

Top Sector in 2014: Office property sector

Of ice

Retail

Logistics

Hotel

45.0%

Others

40.0%

35.0%

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

42.3%

23.2%

10.2%

7.7%

16.3%

The Office property sector investment transactions

accounted for

€

5.85 billion in the fourth quarter and the

yearly volume hit €17.7 million, accounting for 42.3%

of total investment activity across all sectors. Office

properties that are well-located, and contemporary

in appearance and layout continue to be favoured by

investors. The fall in the net initial yield for all asset

classes in most of the major locations in 2014 was

triggered by the increase in demand and relaxed rules

on borrowings.

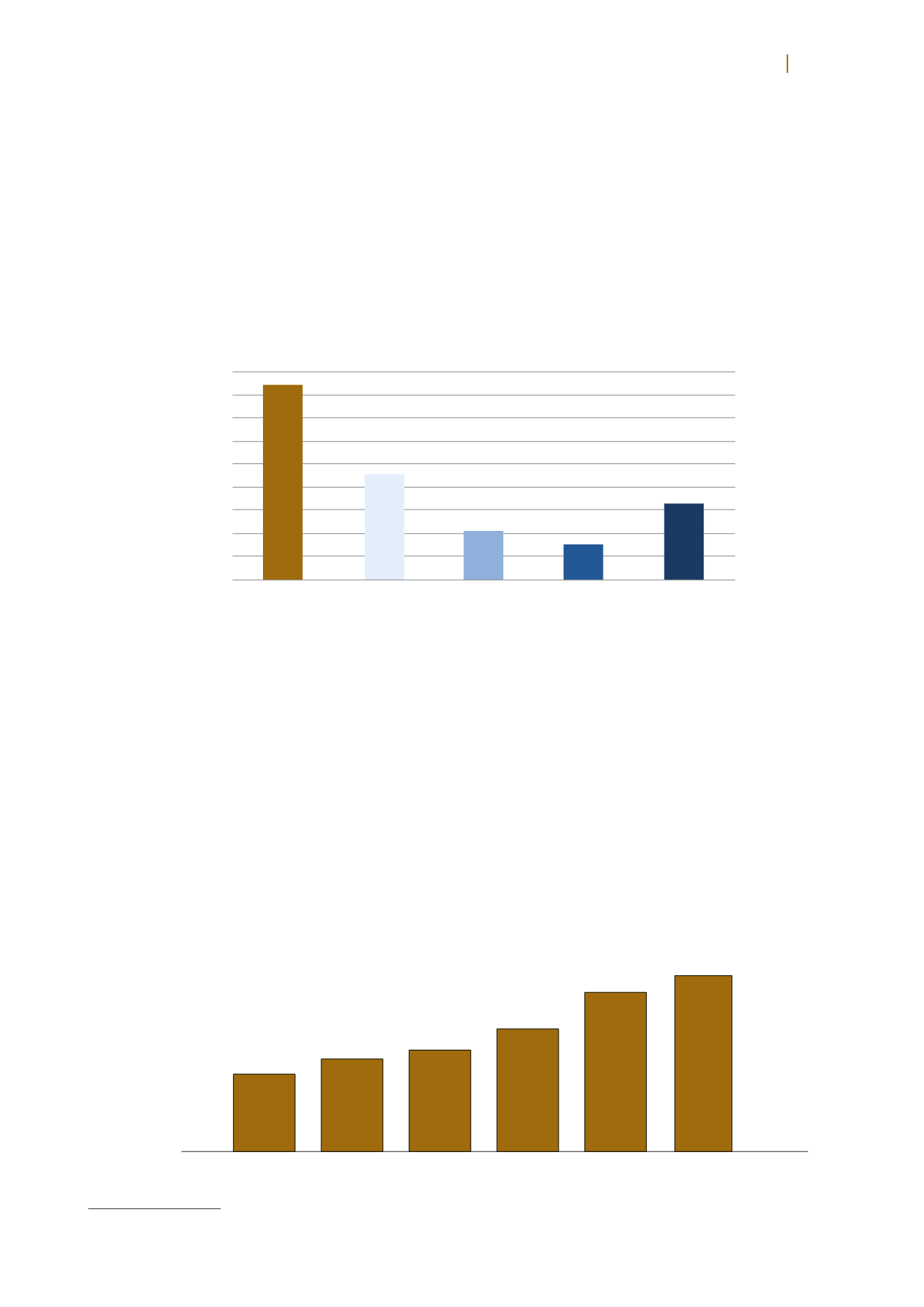

The investment market in Germany grew significantly

in 2014. Approximately €14 billion of real estate

investments were processed in the fourth quarter of

2014which helped end the year with a total transaction

1)

Colliers International – Germany Office Letting and Investment – Market Report 2014/2015

2)

NAI Apollo Group Investment Market Germany Q1 2014 report

volume of €39.8 billion

1

. The largest increase in

investment volume was partially driven by the high

proportion of portfolio transactions.

The total investment in portfolios amounted to €12.4

billion which is a third of the total investment volume

and a 57% increase year-on-year. International investors

continue to drive the market and expand their market

share. In 2014, international investors spent over

€17 billion which translates to an increase of 86%

in the total investment volume. Among some of the

major transactions in 2014 were the sale of the Leo I

portfolio and the Portigon portfolio for approximately

€350 million

2

.

Source: Colliers International – Germany Office Letting and Investment – Market Report 2014/2015

19.4

2010

2011

2012

2013

2014

2015F

23.2

25.4

30.7

39.8

44.0

Commercial Transaction Volume in Germany (€ billions)

Source: BNP Paribas Real Estate – Investment Market Germany – Property Report 2015

IREIT Global

annual report 2014