German

Market Review

1)

Based on Cushman &Wakefield LLP

German Office Market

Strong Office Leasing Activity in Germany

The latest figures from Colliers International Research

Germany showed an increased take up rate in the fourth

quarter in 2014 in the German office leasing market.

Approximately 3million squaremetres (“sqm”) of office

space was leased in the seven key German real estate

hubs: Berlin, Düsseldorf, Frankfurt, Hamburg, Cologne,

Munich and Stuttgart.

While the office markets in Berlin, Hamburg, Cologne,

Munich and Stuttgart all reported an increase in leasing

in 2014 compared with 2013, office take up dropped in

Frankfurt and Düsseldorf. The reason for this has been

identified as the lack of availability of large-scale leasing

deals in Frankfurt and Düsseldorf.

Berlin is undoubtedly the market leader at this time.

With a total take-up of over 700,000 sqm, an increase of

27%when compared to the previous year, Berlin proved

to be the most robust office market. The strong take-up

was primarily driven by demand from occupiers from

the IT and consulting industries which accounted for

approximately one-third of the total take-up.

Munich came in second with a total take-up of

620,900 sqm, an increase of approximately 4% year-

on-year. The high demand was largely driven by an

increase in lettings rather than take-up by owner

occupiers. Hamburg recorded a take-up of approximately

525,000 sqm in 2014, an increase of 19% year-on-year.

In Stuttgart, the take upwas recorded at 278,900 sqm, an

increase of 8%year-on-year and in contrast to the other

major hubs was driven completely by owner occupiers.

The largest owner occupier transaction recordedwas for

Daimler AG, who purchased 40,000 sqm.

The occupier market in Cologne continued to be

fairly stable with a take-up of 269,000 sqm. Frankfurt

recorded a decline in take-up of 18% at approximately

367,500 sqm. The majority of transactions in the city

related to smaller office suites, and there were no

significant transactions on a large scale. The largest

decline was recorded in Düsseldorf. A total take-up of

241,000 sqm signified a decrease of 30% year-on-year.

While the number of lettings in the city increased by

10%, the majority of transactions related to smaller

office suites.

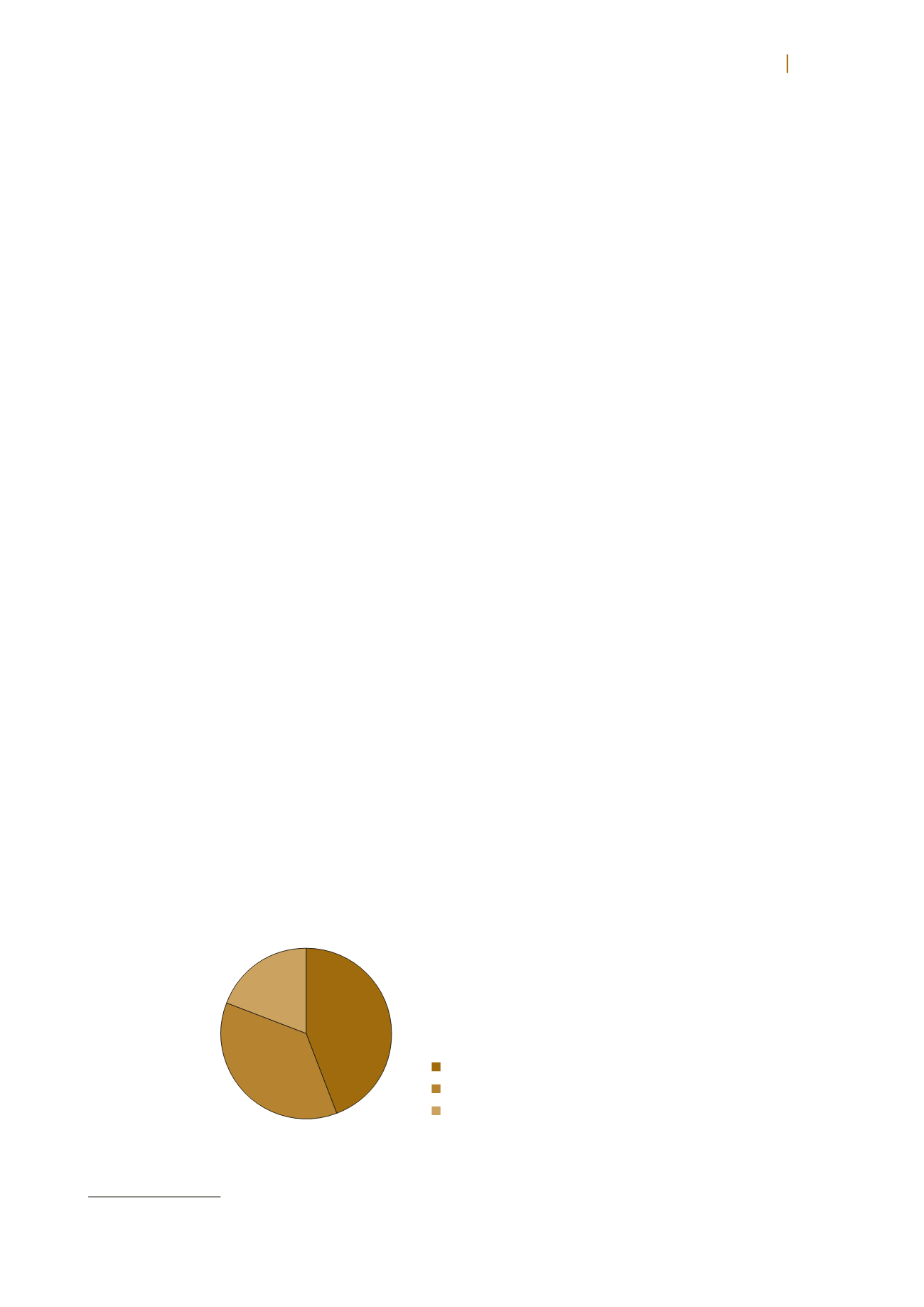

Supply of NewOffice Space

In 2014, the total amount of stock under construction

was approximately 1.43 million sqm. Approximately

44% of the total office stock under construction was

completed in five key cities, namely Berlin, Dusseldorf,

Frankfurt, Munich and Hamburg

1

.

Office stock under construction in 2014

Completed Stock in 2014

Still under construction

Expected stock at the end of 2015

273,900

632,900

523,200

Source: Cushman &Wakefield LLP

IREIT Global

annual report 2014