22.

FINANCIAL INSTRUMENTS (CONTINUED)

(b)

Financial risk management objectives and policies (continued)

/LTXLGLW\ ULVN FRQWLQXHG

7KH *URXSȇV GHULYDWLYH ȴQDQFLDO LQVWUXPHQWV DUH IRUHLJQ FXUUHQF\ IRUZDUGV ZLWK QRWLRQDO DPRXQW WRWDOOLQJ

(85 PLOOLRQ DV DW 'HFHPEHU

(85 PLOOLRQ RI ZKLFK (85 PLOOLRQ

(85

PLOOLRQ ZLOO EH GXH IRU VHWWOHPHQW ZLWKLQ \HDU DQG (85 PLOOLRQ

1LO ZLOO EH GXH EHWZHHQ WR \HDUV

from inception date.

Notes to the

Financial Statements

For the year ended 31 December 2015

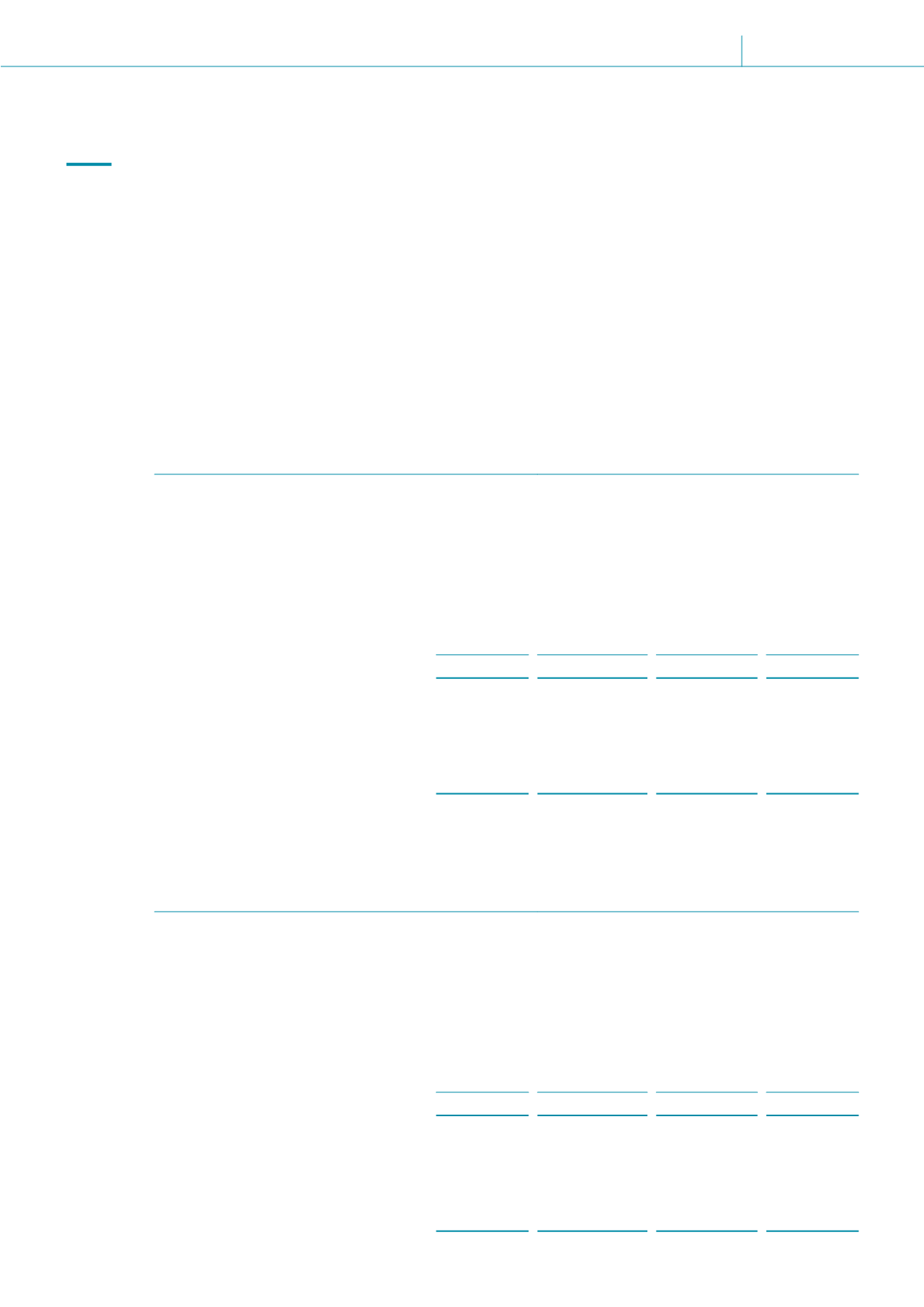

Group

Weighted

average

interest

rate

On demand

or less than

12 months

Undiscounted

FDVK ȵRZV

2 years to

5 years

Adjustments

Carrying

amount

as at 31

December

2015

%

EUR’000

EUR’000

EUR’000

EUR’000

31 December 2015

(i) Non-derivative

ȴQDQFLDO LQVWUXPHQW

- liabilities

1RQ LQWHUHVW EHDULQJ

15,955

-

-

15,955

Fixed interest rate

Instrument

2.03%

3,721

209,054

(15,383)

197,392

19,676

209,054

(15,383)

213,347

LL 'HULYDWLYH ȴQDQFLDO

instrument – gross

settled liability

Foreign exchange

forward contract

392

323

-

715

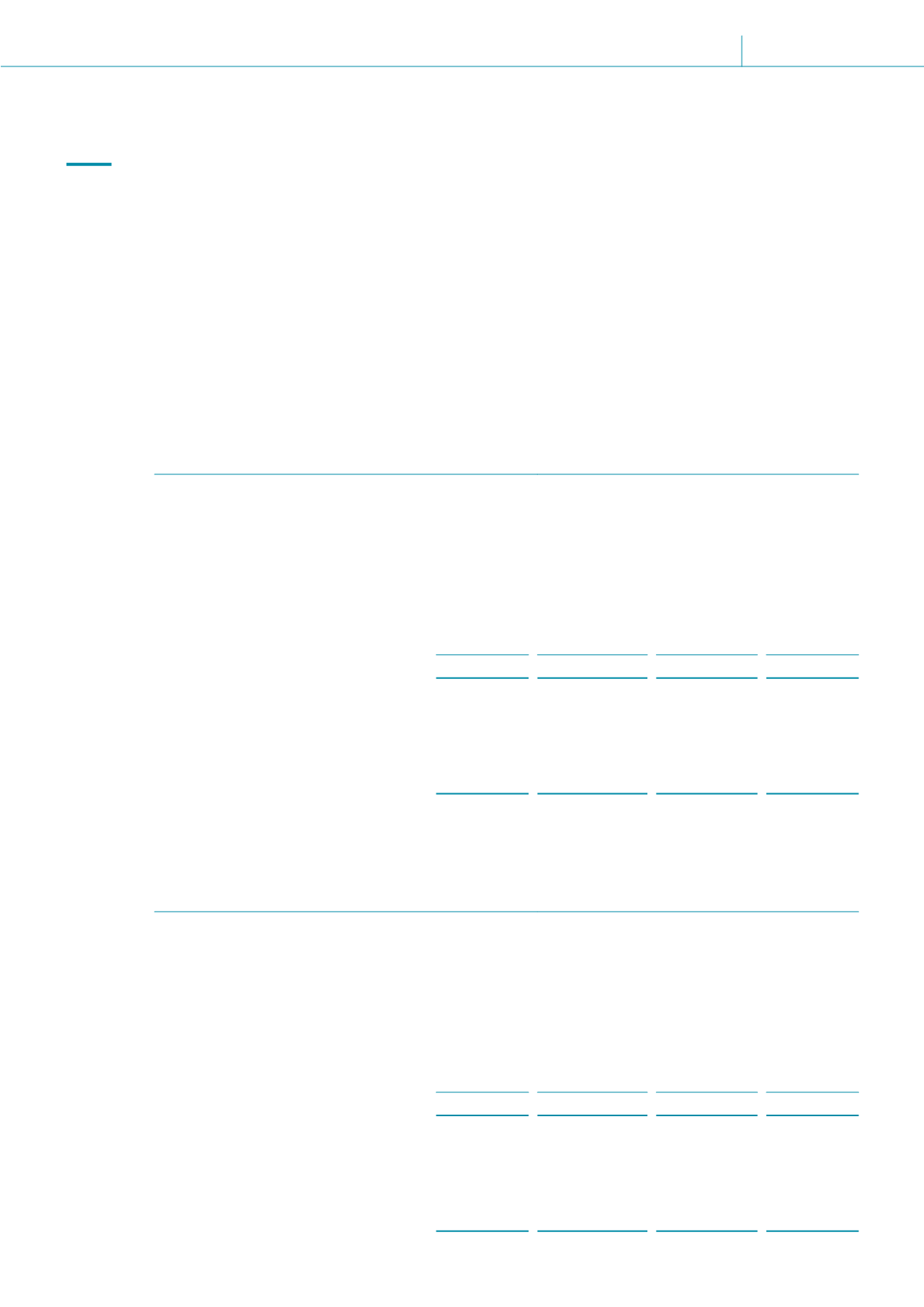

Group

Weighted

average

interest

rate

On demand

or less than

12 months

Undiscounted

FDVK ȵRZV

2 years to

5 years

Adjustments

Carrying

amount

as at 31

December

2014

%

EUR’000

EUR’000

EUR’000

EUR’000

31 December 2014

(i) Non-derivative

ȴQDQFLDO LQVWUXPHQW

- liabilities

1RQ LQWHUHVW EHDULQJ

10,945

-

-

10,945

Fixed interest rate

Instrument

2.11%

1,626

103,219

(9,486)

95,359

12,571

103,219

(9,486)

106,304

LL 'HULYDWLYH ȴQDQFLDO

instrument – gross

settled asset

Foreign exchange

forward contract

279

-

-

279

IREIT Global

ANNUAL REPORT 2015

95