Distribution per Unit (“DPU”) declared for

FY2015 was S$0.0524 comprising S$0.0221

IRU + DQG 6

IRU + 7KH

DPU of S$0.0524 was 25.2% lower than the

IPO Forecast mainly due to the issuance of

new Units from the Rights Issue and the

ZHDNHQLQJ RI WKH (XUR DJDLQVW WKH 6LQJDSRUH

dollar since the IPO.

Financial Review &

Capital Management

REVIEW OF RESULTS

In FY2015, IREIT delivered gross revenue of €26.9 million, exceeding the IPO Forecast of €22.5 million by 19.5%. Rental income

IURP WKH ȴUVW SRVW Ζ32 DFTXLVLWLRQ RI WKH %HUOLQ &DPSXV LQ $XJXVW

FRQWULEXWHG WR Ζ5(Ζ7ȇV VRXUFH RI UHYHQXH &RQVLVWHQW

with the gross revenue growth, net property income was 19.7% higher than forecast of €20.1 million. Distributable income

was 18.3% higher than forecast of €17.6 million.

1

7KH Ζ32 )RUHFDVW ȴJXUHV IRU WKH \HDU HQGHG 'HFHPEHU

ZHUH H[WUDFWHG IURP WKH 3URMHFWLRQ <HDU

DV GLVFORVHG LQ WKH Ζ32 SURVSHFWXV GDWHG

$XJXVW

2

7KH 1$9 SHU 8QLW ZDV FRPSXWHG EDVHG RQ QHW DVVHWV DWWULEXWDEOH WR 8QLWKROGHUV DV DW 'HFHPEHU

DQG 'HFHPEHU

DQG WKH 8QLWV LQ LVVXH

DQG WR EH LVVXHG DV DW 'HFHPEHU

RI

'HFHPEHU

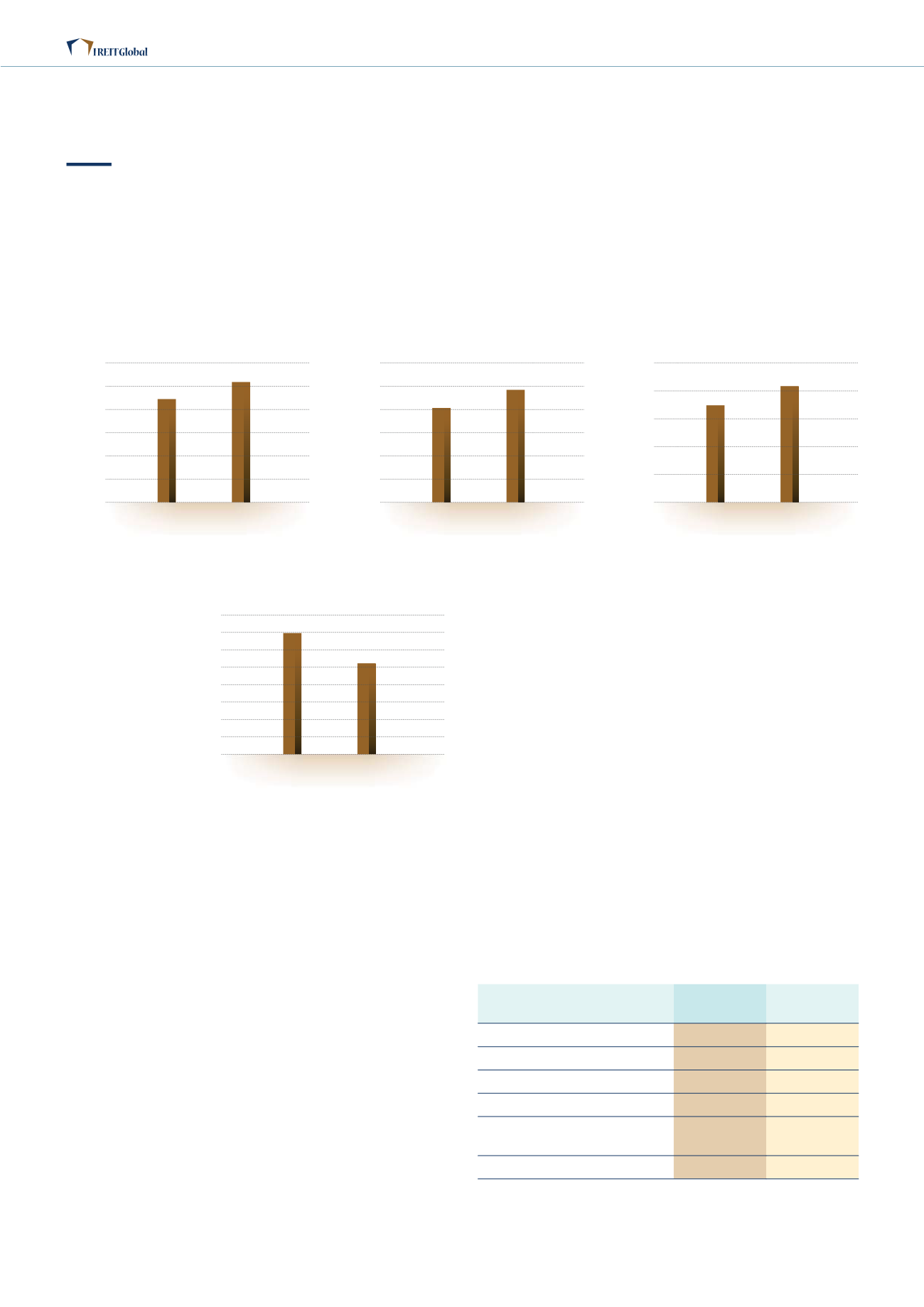

GROSS REVENUE (€’000)

FY2015

Actual

26,924

FY2015

IPO Forecast

(1)

22,534

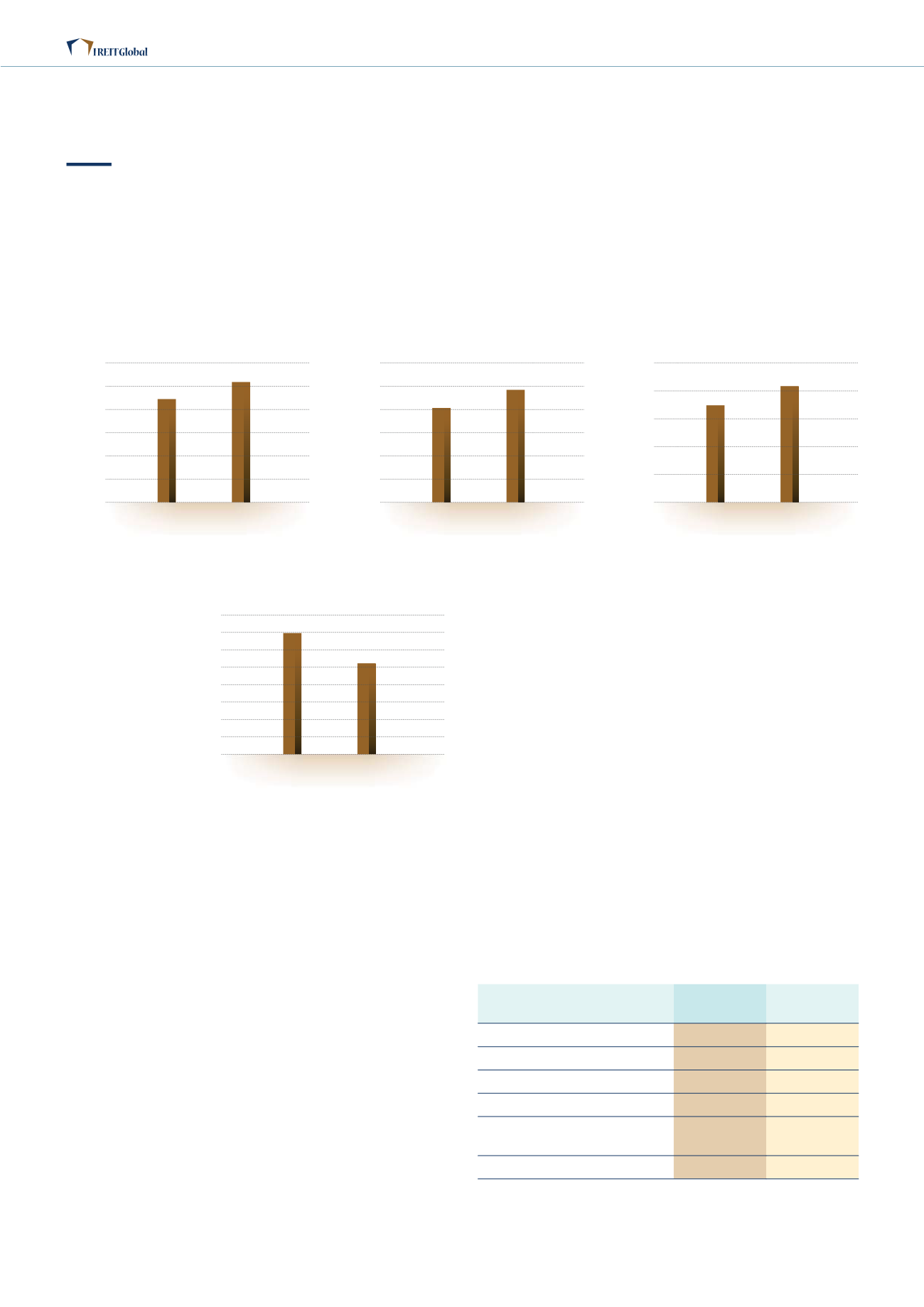

FINANCIAL POSITION

Total assets for the group increased by 52.2% to €466.5

million as at 31 December 2015 from €306.5 million as at

31 December 2014 mainly due to the acquisition of the

%HUOLQ &DPSXV ZKLFK ZDV FRPSOHWHG LQ $XJXVW

$V DW 'HFHPEHU

Ζ5(Ζ7ȇV SURSHUWLHV ZHUH YDOXHG DW

€441.4 million.

Due to the larger Unit base arising from the issuance of

QHZ 8QLWV IURP WKH 5LJKWV ΖVVXH QHW DVVHW YDOXH Ȋ1$9ȋ SHU

8QLW GHFOLQHG WR Ȝ DW WKH HQG RI WKH ȴQDQFLDO \HDU DV

FRPSDUHG WR Ȝ DW WKH EHJLQQLQJ RI WKH ȴQDQFLDO \HDU

Ȝȇ

$V DW

'HF

$V DW

'HF

ΖQYHVWPHQW 3URSHUWLHV

441,400

290,600

7RWDO $VVHWV

466,476

306,514

%RUURZLQJV

197,392

95,359

7RWDO /LDELOLWLHV

215,395

106,540

1HW $VVHWV $WWULEXWDEOH WR

8QLWKROGHUV

251,081

199,974

1$9 SHU 8QLW Ȝ

0.41

0.48

30,000

FY2015

IPO Forecast

(1)

7.01

DISTRIBUTION PER UNIT - S$ cents

8

7

6

5

4

3

2

1

0

FY2015

Actual

5.24

25,000

20,000

15,000

10,000

5,000

0

FY2015

IPO Forecast

(1)

20,067

FY2015

Actual

24,029

NET PROPERTY INCOME (€’000)

30,000

25,000

20,000

15,000

10,000

5,000

0

DISTRIBUTABLE INCOME (€’000)

FY2015

IPO Forecast

(1)

17,572

20,782

FY2015

Actual

25,000

20,000

15,000

10,000

5,000

0

7KH WRWDO RSHUDWLQJ H[SHQVHV RI Ζ5(Ζ7 LQFOXGLQJ DOO IHHV DQG FKDUJHV SDLG WR WKH 0DQDJHU DQG LQWHUHVWHG SDUWLHV IRU )<

amounted to €7,188,000, representing 2.86% of the net assets attributable to Unitholders as at 31 December 2015. There

were no taxation incurred on the real estate assets for FY2015.

18